HOWMET AEROSPACE Reports Second Quarter Earnings for Fiscal Year 2023

August 5, 2023

🌥️Earnings Overview

On August 1, 2023, HOWMET AEROSPACE ($NYSE:HWM) released their earnings report for the second quarter of fiscal year 2023, which ended on June 30, 2023. Total revenue grew by 18.3% compared to the same quarter the previous year, reaching USD 1648.0 million. Net income rose as well, reaching USD 193.0 million, an increase of 31.3% year over year.

Stock Price

Stock opened at $49.7 and closed at $49.0, which was a 4.2% decrease from the prior closing price of 51.1. The weaker-than-expected earnings were due to weak demand for the company’s jet engines and other components for commercial aircraft. This weakness was reflected in the company’s guidance for the next quarter, as they predicted revenues to decline by up to 4%. Despite the weak outlook, the company reaffirmed its commitment to delivering long-term value to shareholders through its cost-saving initiatives and investments in new technology.

In response to the earnings report, HOWMET AEROSPACE shares fell sharply, dropping 4.2% from the prior closing price of 51.1 to finish the day down at 49.0. Investors are now closely watching the company’s next quarter earnings report to see if the outlook improves or further declines. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Howmet Aerospace. More…

| Total Revenues | Net Income | Net Margin |

| 6.2k | 530 | 10.3% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Howmet Aerospace. More…

| Operations | Investing | Financing |

| 772 | -175 | -598 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Howmet Aerospace. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 10.23k | 6.46k | 9.16 |

Key Ratios Snapshot

Some of the financial key ratios for Howmet Aerospace are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -22.9% | -12.4% | 15.2% |

| FCF Margin | ROE | ROA |

| 9.4% | 15.6% | 5.7% |

Analysis

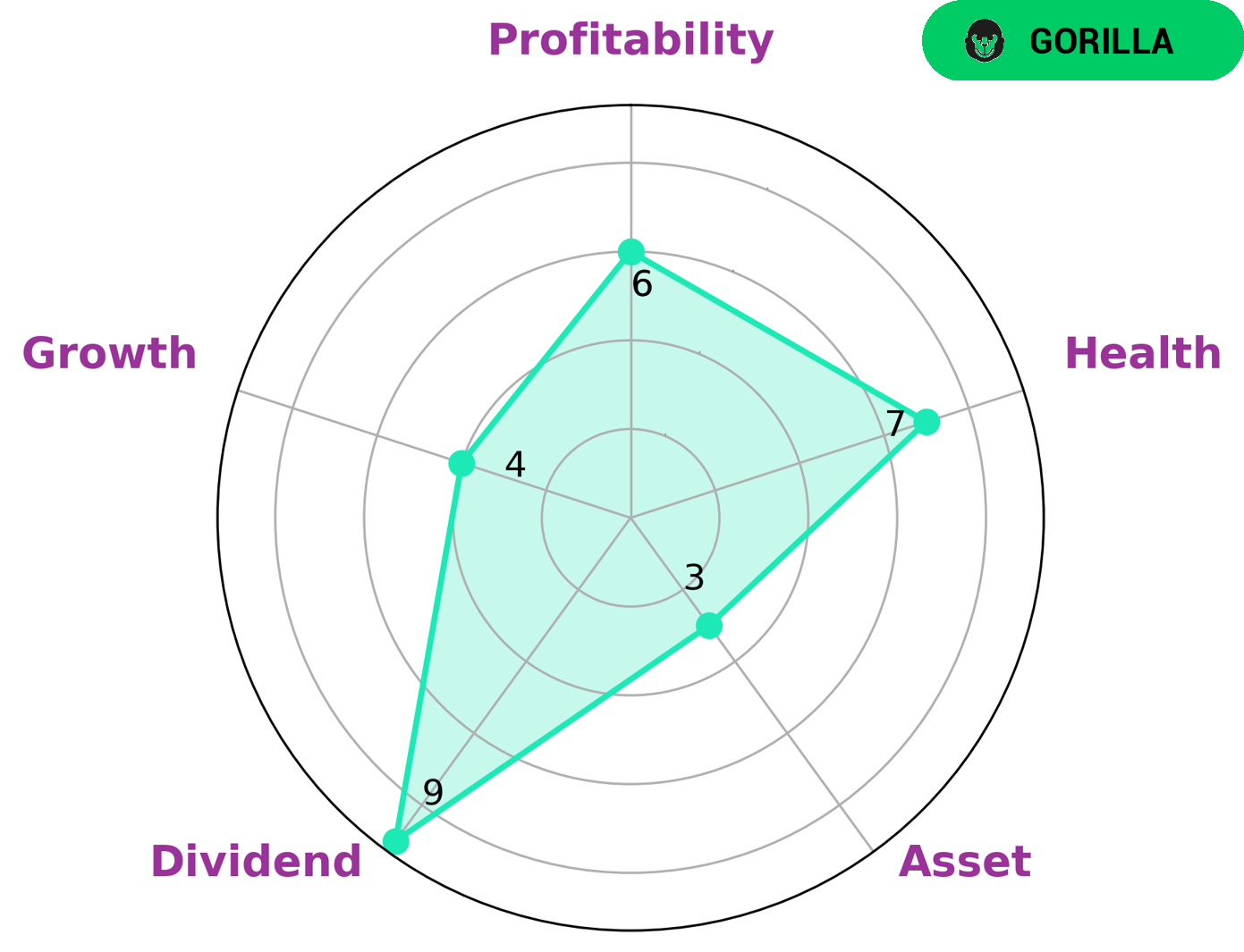

We at GoodWhale conducted an analysis of HOWMET AEROSPACE‘s wellbeing and our Star Chart gave it an intermediate health score of 6/10. This score is based on the company’s cashflows and debt, which suggest HOWMET AEROSPACE is likely to safely ride out any crisis without the risk of bankruptcy. By our classification, we determined that HOWMET AEROSPACE is a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. We found that HOWMET AEROSPACE was strong in dividend, medium in profitability and weak in asset and growth. Considering this, we conclude that value investors and dividend investors may be the most likely to be interested in investing in this company. Such investors are likely to appreciate the steady cashflows and dividend yield that HOWMET AEROSPACE provides, as well as its moderate revenue and earnings growth. More…

Peers

Its main competitors are Rolls-Royce Holdings PLC, General Dynamics Corp, and Raytheon Technologies Corp.

– Rolls-Royce Holdings PLC ($LSE:RR.)

Rolls-Royce Holdings PLC is a British multinational engineering company incorporated in February 2011 that owns Rolls-Royce, a business founded in 1904 which today designs, manufactures and distributes power systems for aviation and other industries.

The company has a market cap of 7.25B as of 2022 and a Return on Equity of 21.06%. Rolls-Royce is a global leader in the design, manufacture and distribution of power systems for aviation and other industries. The company’s products and services power more than 35,000 aircraft and over 10,000 ships worldwide.

– General Dynamics Corp ($NYSE:GD)

General Dynamics Corporation is an American aerospace and defense conglomerate company formed by mergers and divestitures, and as of 2012, it is the fifth largest defense contractor in the world. It is headquartered in West Falls Church, The company has a market cap of 68.15B as of 2022 and a Return on Equity of 15.38%. The company is involved in the design, development, and manufacture of products and services for the aerospace and defense industries.

– Raytheon Technologies Corp ($NYSE:RTX)

Raytheon Technologies Corporation is an aerospace and defense company that provides products and services for the commercial, military, and government markets. The company has a market cap of 140.18B as of 2022 and a Return on Equity of 5.82%. Raytheon Technologies is a technology leader in defense, security, and commercial aerospace. The company’s products and services include aircraft engines, radar, and other electronic systems.

Summary

HOWMET AEROSPACE reported strong second quarter earnings for the fiscal year 2023, with total revenue up 18.3% and net income up 31.3% year over year. Despite these positive results, the stock price fell for the day. For investors, this could be a good opportunity to buy into the company as its sound financials make it a viable long-term investment.

Additionally, its strong second quarter earnings suggest that the company is well-positioned to continue its growth trajectory. It may also be worth keeping an eye on the company as it continues to expand its operations and explore new markets.

Recent Posts