HEXCEL CORPORATION Blows Away Earnings and Revenue Estimates

April 25, 2023

Trending News 🌥️

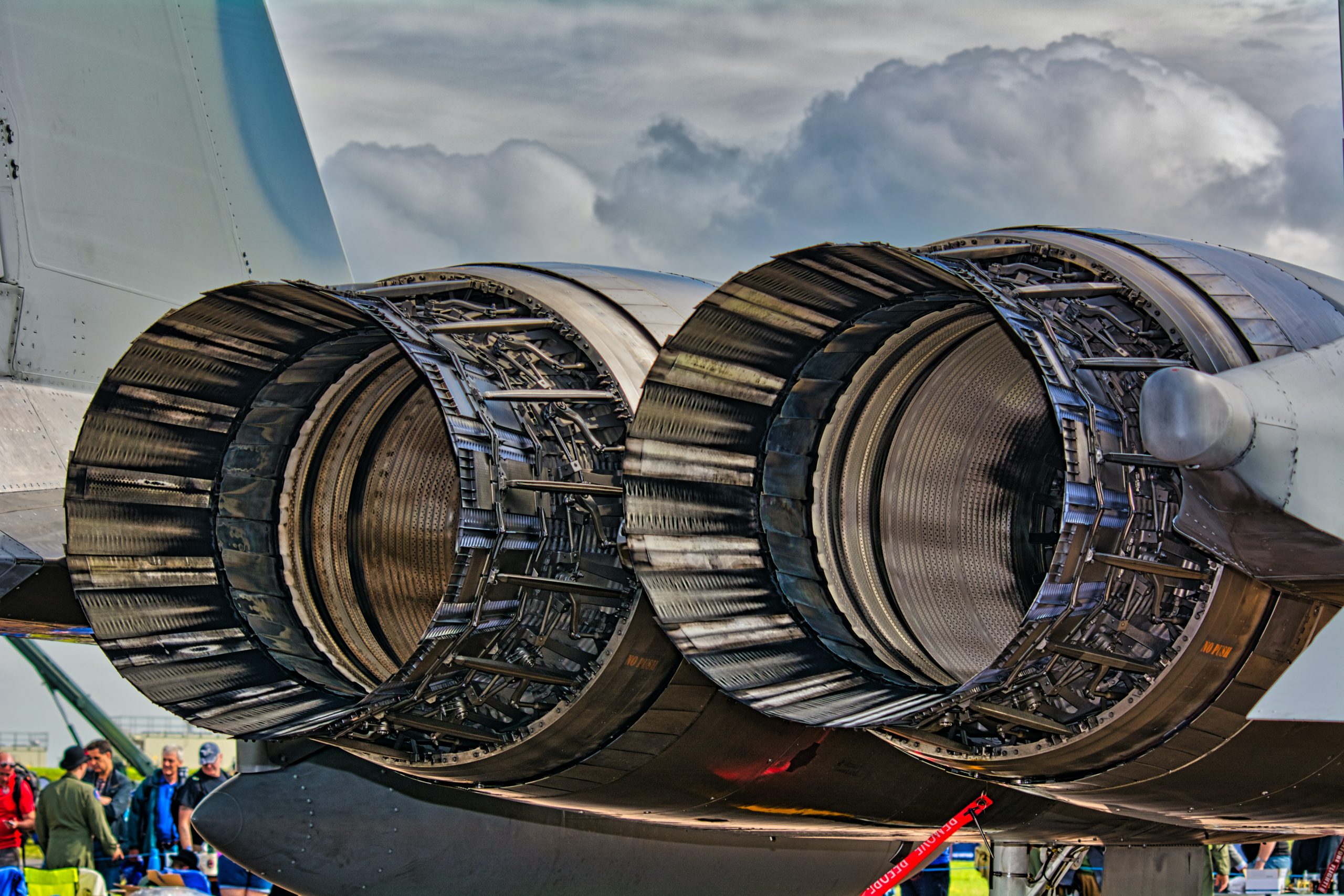

HEXCEL CORPORATION ($NYSE:HXL), a global leader in advanced and engineered materials, recently reported its financial results for the fourth quarter. The company blew away expectations, with Non-GAAP Earnings Per Share of $0.50 surpassing estimates by $0.12 and total revenue of $457.7M higher than predicted by $24.29M. HEXCEL CORPORATION is one of the world’s leading producers of carbon fiber, reinforcement fabrics and other advanced materials used in high-performance applications.

The company also produces high-performance materials and products that are used in a variety of industrial, commercial and aerospace applications in diverse industries such as wind energy and sporting goods. Through its commitment to innovation and customer service, HEXCEL CORPORATION continues to lead the way in developing new materials for the future.

Stock Price

On Monday, HEXCEL CORPORATION stock opened at $68.1 and closed at $68.6, up by 0.5% from last closing price of 68.2. This was likely due to the company’s recent earnings and revenue estimates that have far exceeded expectations. The positive results indicate that the company is in good financial health and is well-positioned to continue to perform well in the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Hexcel Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 1.58k | 126.3 | 8.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Hexcel Corporation. More…

| Operations | Investing | Financing |

| 173.1 | -54.6 | -130 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Hexcel Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.84k | 1.28k | 17.18 |

Key Ratios Snapshot

Some of the financial key ratios for Hexcel Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -12.5% | -25.6% | 11.8% |

| FCF Margin | ROE | ROA |

| 6.1% | 7.8% | 4.1% |

Analysis

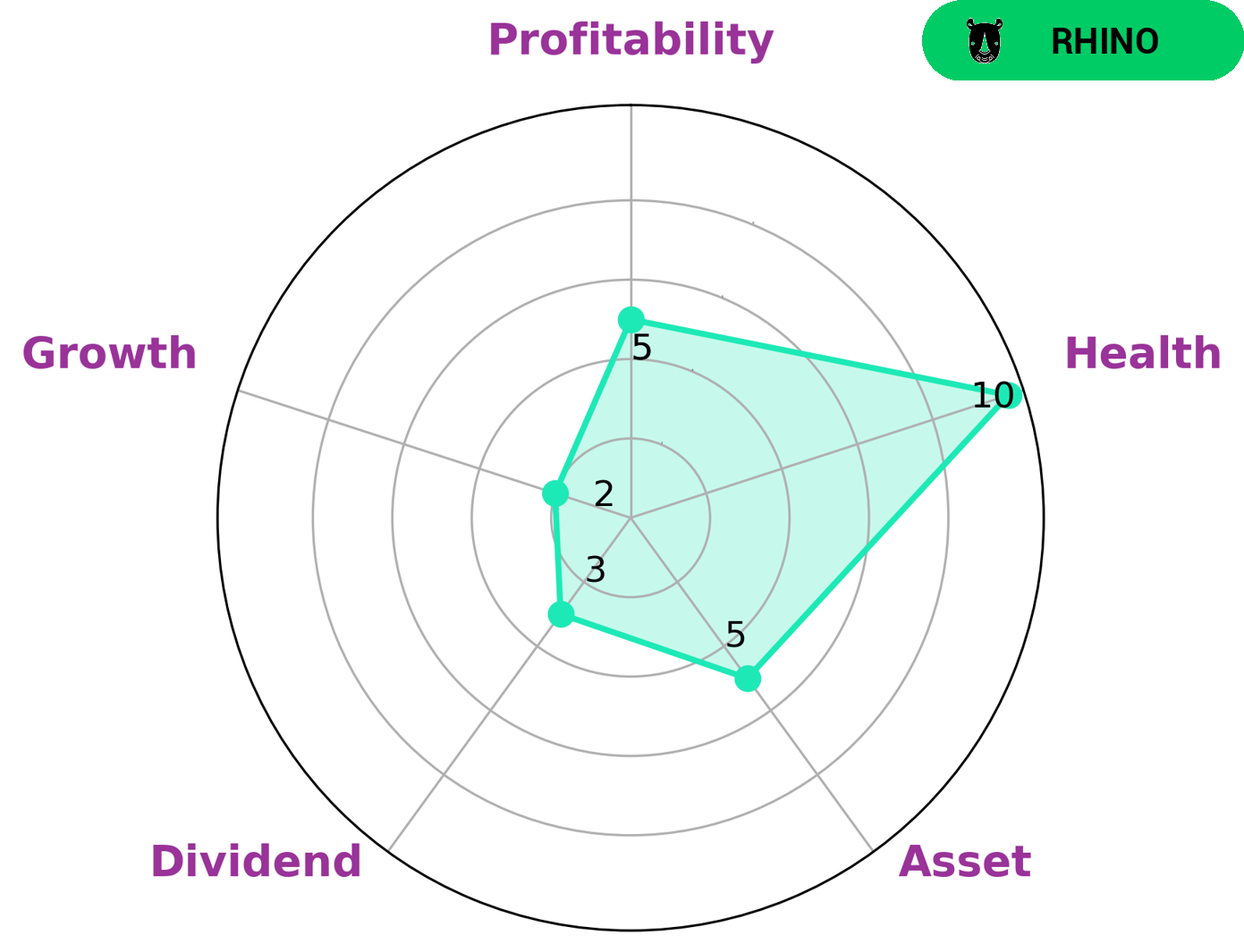

GoodWhale has analyzed the financials of HEXCEL CORPORATION. Our star chart shows that this company is strong in asset, medium in profitability and weak in dividend and growth. We classify HEXCEL CORPORATION as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. This type of company may be interesting for investors who are looking for a moderate investment option with a low risk of losses. HEXCEL CORPORATION has a high health score of 10/10, indicating that it is financially capable to pay off debts and fund its future operations. This makes HEXCEL CORPORATION an attractive option for investors who are looking for a low-risk but steady investment. More…

Peers

The company competes with Beijing Beimo High Tech Frictional Material Co Ltd, Textron Inc, and Lockheed Martin Corp, among others.

– Beijing Beimo High Tech Frictional Material Co Ltd ($SZSE:002985)

As of 2022, Beijing Beimo High Tech Frictional Material Co Ltd has a market cap of 15.99B and a return on equity of 14.34%. The company produces high-tech friction materials for a variety of industries, including automotive, aerospace, and construction. Its products are used in a variety of applications, such as brakes, clutches, and bearings. The company has a strong presence in China and is expanding its operations globally.

– Textron Inc ($NYSE:TXT)

Textron Inc is a diversified industrial company that operates in a variety of businesses, including aircraft, defense, industrial, and finance. The company has a market cap of 13.31B as of 2022 and a return on equity of 9.94%. Textron is a global company with operations in more than 40 countries. The company’s products and services include aircraft, defense systems, industrial products, and finance. Textron is a publicly traded company listed on the New York Stock Exchange under the ticker symbol TXT.

– Lockheed Martin Corp ($NYSE:LMT)

Lockheed Martin Corp is an American aerospace, defense, security, and advanced technologies company. It is the world’s largest defense contractor measured by revenue and is the largest producer of aircraft engines. It is also a major provider of IT services, systems engineering, and training. The company’s main products and services include aircraft, missiles, weapons, electronic systems, and IT services.

Summary

Hexcel Corporation is a leading manufacturer of advanced composite materials for the aerospace, defense, and industrial markets. This was driven by strong growth across all end-markets and higher volumes in the industrial and commercial aerospace markets due to increased demand for aircraft components. Hexcel’s strong quarterly performance indicates that the company is well-positioned to capitalize on opportunities within the aerospace industry, making it an attractive stock for long-term investors.

Recent Posts