General Dynamics Stock Fair Value – GENERAL DYNAMICS Reports Second Quarter FY2023 Earnings Results on June 30th 2023

August 1, 2023

☀️Earnings Overview

On June 30th 2023, GENERAL DYNAMICS ($NYSE:GD) reported their financial results for the second quarter of FY2023, which concluded on that date. Revenue for the period was USD 10152.0 million, a rise of 10.5% compared to the same quarter of the previous year. Unfortunately, net income was USD 744.0 million, a decrease of 2.9% from the same period of the previous year.

Price History

On Wednesday, the stock opened at $220.2 and closed at $222.8, a 2.2% increase from its last closing price of $218.0. This closing price represented a new yearly high for GENERAL DYNAMICS stock, as the company continues to remain a top-tier aerospace and defense corporation. The market responded positively to the results, as investors were impressed with the company’s strong performance. The report showed that GENERAL DYNAMICS achieved double-digit growth in revenue and earnings per share.

Looking ahead, GENERAL DYNAMICS has outlined several plans for the future, including acquisitions and investments across geographic boundaries. They are also continuing to develop innovative products and services to stay ahead of the competition in the aerospace and defense industry. With their strong results and future plans, it appears that GENERAL DYNAMICS will continue to be a solid performer in the industry for the foreseeable future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for General Dynamics. More…

| Total Revenues | Net Income | Net Margin |

| 40.86k | 3.37k | 8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for General Dynamics. More…

| Operations | Investing | Financing |

| 4.14k | -1.53k | -3.68k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for General Dynamics. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 52.56k | 33.08k | 71 |

Key Ratios Snapshot

Some of the financial key ratios for General Dynamics are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 2.0% | -0.8% | 10.9% |

| FCF Margin | ROE | ROA |

| 7.4% | 14.4% | 5.3% |

Analysis – General Dynamics Stock Fair Value

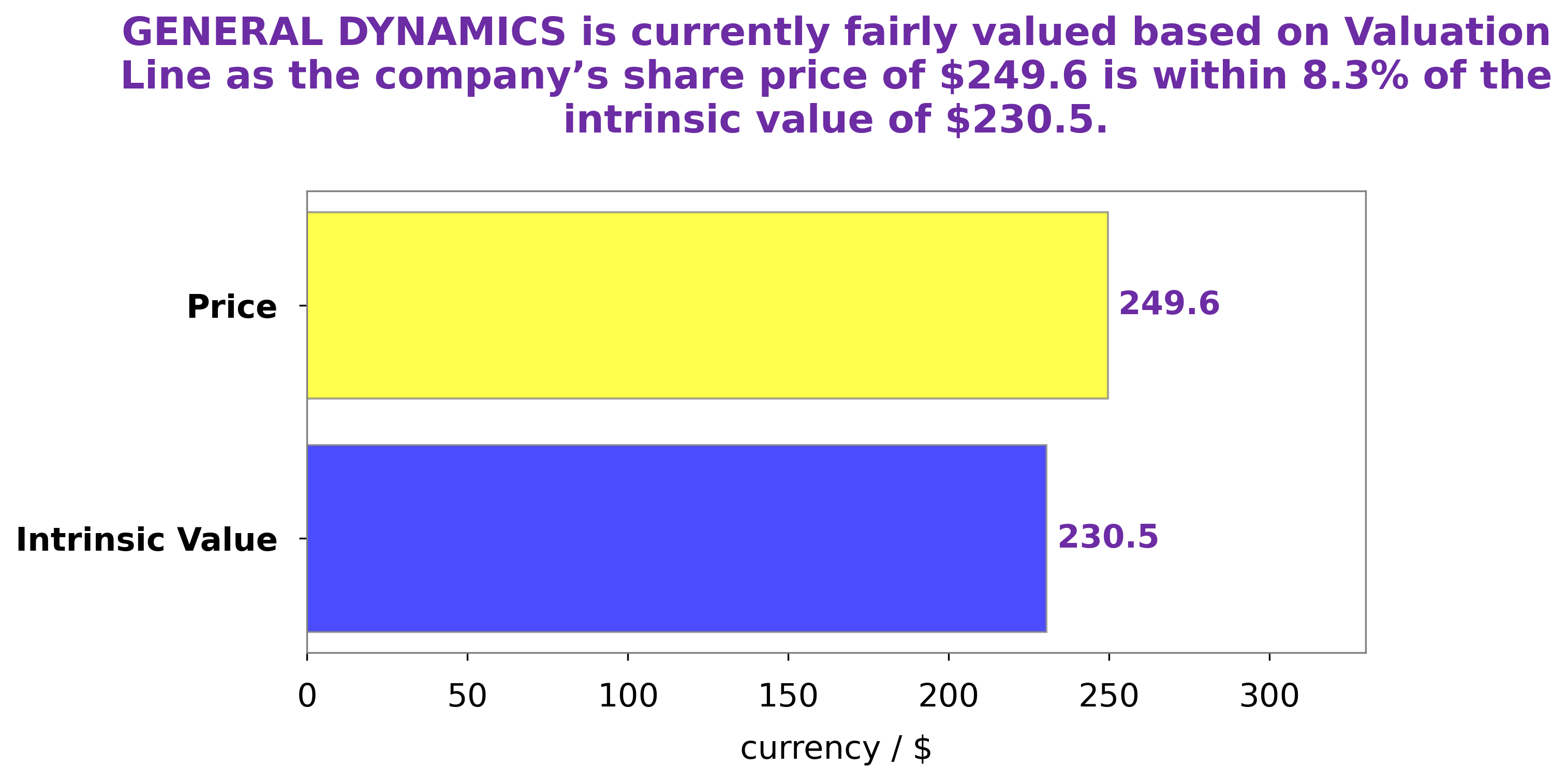

At GoodWhale, we have conducted an analysis of GENERAL DYNAMICS‘s fundamentals and concluded that the intrinsic value of its share is around $220.2, as calculated by our proprietary Valuation Line. At the time of writing, GENERAL DYNAMICS’s stock is trading at $222.8, which means it is currently slightly overvalued by 1.2%. We believe it is a fair price to buy the shares at the present moment, as they may offer the investor a slightly better return in the future. More…

Peers

General Dynamics Corp is one of the world’s leading aerospace and defense companies. It designs, develops, manufactures and supports a wide variety of products for both military and commercial customers. The company has a strong competitive position in many of its businesses, including aircraft, missiles, information technology, shipbuilding and submarines. Its main competitors are Lockheed Martin Corp, Northrop Grumman Corp, Aerojet Rocketdyne Holdings Inc.

– Lockheed Martin Corp ($NYSE:LMT)

Lockheed Martin Corp is a global security and aerospace company. It is principally engaged in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services. The company has a market cap of 115.3B as of 2022 and a Return on Equity of 40.32%. Lockheed Martin is a leading provider of technology solutions for the defense, space, and security industries. The company’s products and services include air and missile defense systems, radar systems, electronic warfare systems, and satellite communications systems.

– Northrop Grumman Corp ($NYSE:NOC)

Northrop Grumman Corporation is an American global aerospace and defense technology company formed by the merger of Northrop Corporation and Grumman Corporation on January 6, 1996. The company has a market cap of 79.04B as of 2022 and a Return on Equity of 34.54%. Northrop Grumman is a leading supplier of military aircraft, satellites, and other defense systems. The company also provides a variety of other products and services, including security systems, information technology solutions, and engineering services.

– Aerojet Rocketdyne Holdings Inc ($NYSE:AJRD)

Aerojet Rocketdyne Holdings Inc is a holding company for Aerojet Rocketdyne, Inc, a leading aerospace and defense company. The company’s market cap as of 2022 was 3.5 billion, and its ROE was 21.2%. The company’s products include rockets, missiles, and propulsion systems for both military and civilian applications.

Summary

General Dynamics’ earnings for the second quarter of 2023 were a mixed bag, with total revenue up 10.5% to USD 10152.0 million, but net income down 2.9%. This shows that while the company is growing, it is likely due to increased spending rather than to higher profits. Investors should watch closely for any improvements in financial performance and cost-cutting measures in future quarters to ensure that the company is headed in the right direction. Additionally, dividend payouts and stock buybacks may be worth considering when evaluating potential investments in the company.

Recent Posts