Axon Enterprise Stock Fair Value Calculator – Axon Enterprise Reports Q4 Earnings Surpassing Expectations, Revenues Up 8% YoY

May 10, 2023

Trending News 🌥️

Axon Enterprise ($NASDAQ:AXON) (formerly known as TASER International) has reported its Q4 earnings, surpassing expectations across the board. The company reported Non-GAAP earnings per share of $0.88, which is $0.34 higher than the expected figure. Axon Enterprise is a technology company committed to protecting life and making the world a safer place. It develops technology, hardware, and software solutions for law enforcement in public safety, including connected devices such as body cameras, software, and weapons.

The company’s mission is to protect life and make the world a safer place, and it focuses on providing law enforcement with the tools they need to fight crime and reduce violence. The company’s strong performance in the quarter indicates that its efforts to provide law enforcement with the tools they need to fight crime and reduce violence have been successful. With the introduction of new products, such as its body cameras and software solutions, Axon Enterprise is well-positioned to continue its growth in the future.

Earnings

AXON ENTERPRISE recently reported its Q4 earning results of FY2022, surpassing expectations. As of December 31 2022, the company had earned 336.14M USD in total revenue and 29.18M USD in net income. This is a marked improvement over the previous year, with total revenue increasing by 54.5% and net income decreasing by 316%. In the last three years, AXON ENTERPRISE’s total revenue has grown from 226.14M USD to 336.14M USD.

This demonstrates the company’s commitment to continued success and growth in the coming years. With the continued focus on strategic investments and innovative products, AXON ENTERPRISE is well-positioned for future success.

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Axon Enterprise. More…

| Total Revenues | Net Income | Net Margin |

| 1.19k | 147.14 | 12.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Axon Enterprise. More…

| Operations | Investing | Financing |

| 235.36 | -830.97 | 598.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Axon Enterprise. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.85k | 1.58k | 17.75 |

Key Ratios Snapshot

Some of the financial key ratios for Axon Enterprise are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.9% | -11.1% | 7.8% |

| FCF Margin | ROE | ROA |

| 15.1% | 4.7% | 2.0% |

Analysis – Axon Enterprise Stock Fair Value Calculator

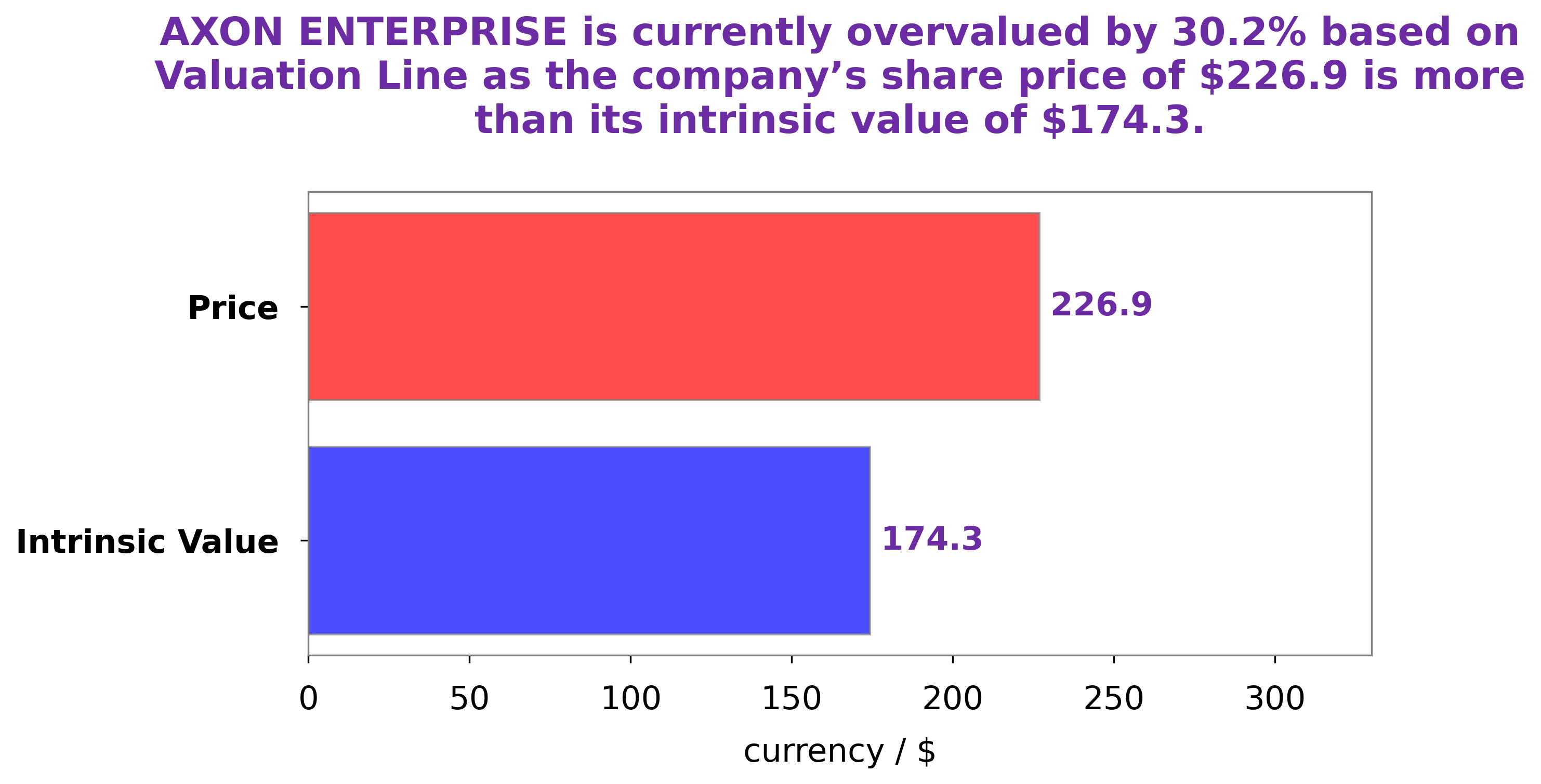

At GoodWhale, we recently conducted an analysis of the fundamentals of AXON ENTERPRISE. Our proprietary Valuation Line indicates that the fair value of AXON ENTERPRISE shares is around $174.3. However, the current trading value of AXON ENTERPRISE shares is $226.9, which implies the stock is overvalued by 30.2%. More…

Peers

Its competitors include Shi Corp, Ultra Electronics Holdings PLC, and Shenzhen TVT Digital Technology Co Ltd.

– Shi Corp ($OTCPK:SHCC)

Shi Corp is a publicly traded company with a market capitalization of 1.39k as of 2022. The company has a Return on Equity of -0.64%. Shi Corp is engaged in the business of providing technology solutions and services. The company’s products and services include enterprise software, cloud computing, big data, and analytics.

– Ultra Electronics Holdings PLC ($SZSE:002835)

Shenzhen TVT Digital Technology Co Ltd has a market cap of 2.64B as of 2022, a Return on Equity of 8.41%. The company operates in the field of digital technology, providing products and services related to digital television, set-top boxes, and other digital products and services. It is headquartered in Shenzhen, China.

Summary

Axon Enterprise Inc. recently reported its earnings for the quarter, posting strong results that beat analyst expectations. The company reported non-GAAP earnings per share of $0.88, representing an increase of $0.34 over expected numbers. Revenue for the quarter amounted to $343.04 million, a beat of $23.3 million compared to analyst predictions. The company’s stock is likely to be positively impacted by the impressive earnings report, and investors should watch for any additional news or developments emanating from Axon Enterprise.

Recent Posts