Axon Enterprise Intrinsic Value Calculator – 2023 a Record Year for Axon Enterprise (AXON) with Multiple Reasons for Outperformance

March 30, 2023

Trending News 🌥️

In 2023, Axon Enterprise ($NASDAQ:AXON) (AXON) is set to become a record year for the company. This is thanks to many reasons that have resulted in its outperformance. At the core of AXON’s success is its focus on using technology to help public safety organizations keep their communities safe. The company offers a range of products such as body-worn cameras, digital evidence management services, and cloud-based software solutions to aid law enforcement and other public safety organizations. One of the primary reasons for AXON’s superior performance is its commitment to innovation. It has invested heavily in research and development, enabling it to introduce new products and services to the market. This has allowed AXON to stay ahead of the competition, while also providing customers with the best possible solutions.

Additionally, it has been able to increase sales and market share, as more customers turn to AXON for their needs. Furthermore, AXON has also been able to benefit from its strong financial position. The company has maintained a healthy balance sheet, with a high level of cash reserves and low debt levels. This has enabled AXON to make strategic investments and focus on long-term growth opportunities. This has been further aided by its ability to generate strong cash flow from operations, which has allowed it to continue funding its operations and product development while still remaining profitable. The company’s commitment to innovation and its strong financial position are just two of the main factors driving its success. With these trends expected to continue, it can be expected that AXON will remain a leader in the industry for many years to come.

Share Price

The company’s stock opened at $218.8 and closed at $218.6, a 0.9% increase from its prior closing price of 216.6. This impressive performance was due to multiple reasons and it demonstrates the continued positive trajectory of the company. One of the major drivers of this outperformance is the strong focus on research and development that AXON has adopted in recent years. This has helped them stay ahead of the competition when it comes to introducing revolutionary technologies and products to the market.

Additionally, AXON has made significant investments in marketing, advertising and customer service, resulting in an influx of new customers and an increase in brand awareness. Another reason for AXON’s success is their commitment to sustainability and environmental responsibility. The company has implemented numerous initiatives such as reducing emissions, increasing energy efficiency, and using renewable energy sources. These measures have enabled AXON to maintain a strong commitment to sustainable practices while also staying competitive in the market. Overall, with its continued focus on research and development, investments in marketing and customer service, as well as its commitment to sustainability, AXON has positioned itself for great success in 2023 and beyond. Its stock price increase on Monday is an indicator of this potential and shows that the company is well-prepared to continue its record-setting performance in the years to come. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Axon Enterprise. More…

| Total Revenues | Net Income | Net Margin |

| 1.19k | 147.14 | 12.4% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Axon Enterprise. More…

| Operations | Investing | Financing |

| 235.36 | -830.97 | 598.1 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Axon Enterprise. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.85k | 1.58k | 17.75 |

Key Ratios Snapshot

Some of the financial key ratios for Axon Enterprise are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 30.9% | -11.1% | 7.8% |

| FCF Margin | ROE | ROA |

| 15.1% | 4.7% | 2.0% |

Analysis – Axon Enterprise Intrinsic Value Calculator

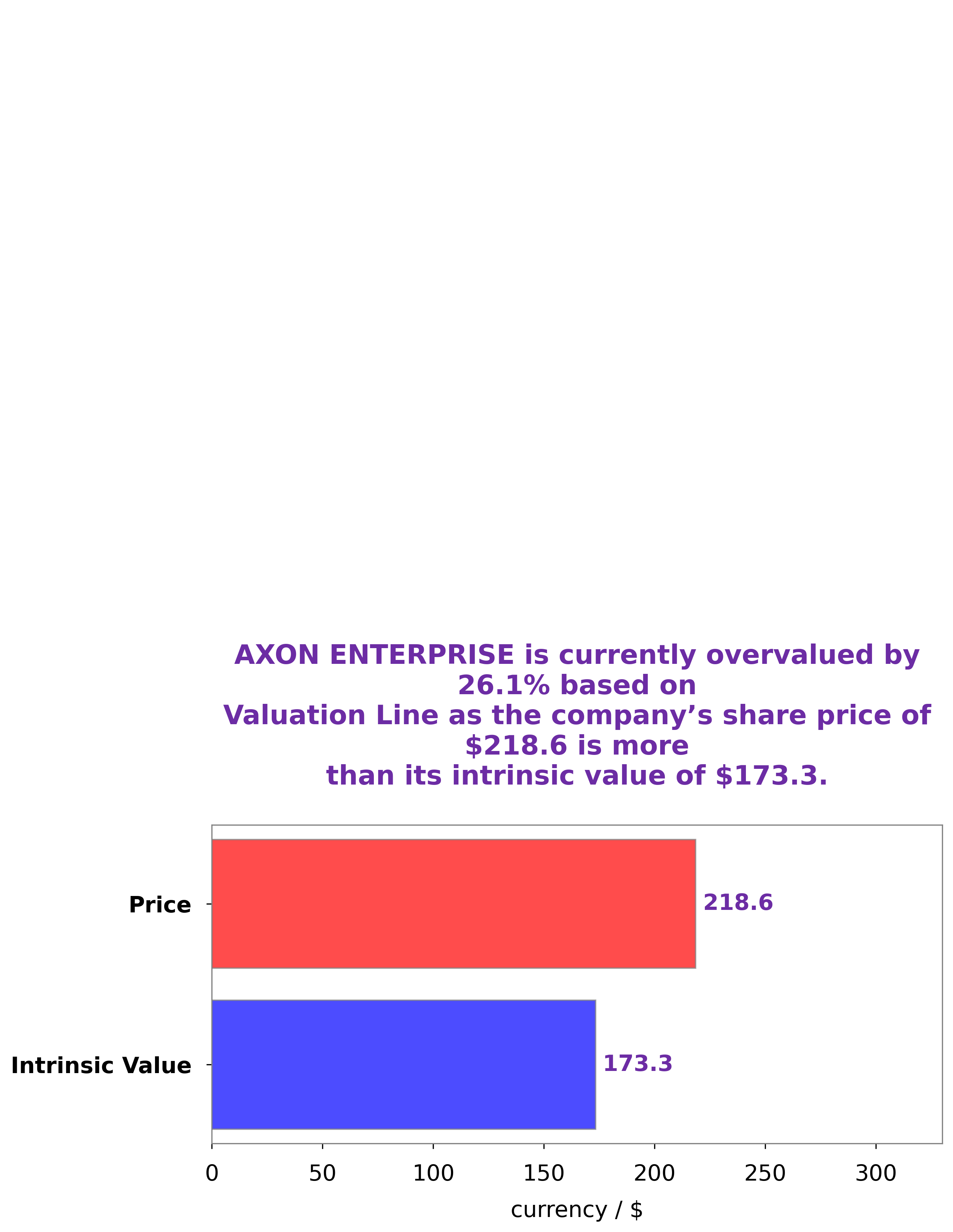

At GoodWhale, we have conducted an analysis of AXON ENTERPRISE‘s financials and have calculated their fair value to be around $173.3. Our proprietary Valuation Line has taken into account the stock’s current market conditions, the company’s prospects and risks, the industry environment, and other factors to determine the fair value of AXON ENTERPRISE shares. At present, AXON ENTERPRISE shares are being traded at a price of $218.6, which is overvalued by 26.2%. We believe that this may not be a sustainable value and that in the long run, the stock may be undervalued if the current market trend continues. As such, investors should be aware of this risk before investing in AXON ENTERPRISE stock. More…

Peers

Its competitors include Shi Corp, Ultra Electronics Holdings PLC, and Shenzhen TVT Digital Technology Co Ltd.

– Shi Corp ($OTCPK:SHCC)

Shi Corp is a publicly traded company with a market capitalization of 1.39k as of 2022. The company has a Return on Equity of -0.64%. Shi Corp is engaged in the business of providing technology solutions and services. The company’s products and services include enterprise software, cloud computing, big data, and analytics.

– Ultra Electronics Holdings PLC ($SZSE:002835)

Shenzhen TVT Digital Technology Co Ltd has a market cap of 2.64B as of 2022, a Return on Equity of 8.41%. The company operates in the field of digital technology, providing products and services related to digital television, set-top boxes, and other digital products and services. It is headquartered in Shenzhen, China.

Summary

AXON Enterprise (AXON) has had a record-breaking year in 2023, with its share price significantly outperforming the market. This is due to a combination of factors, such as positive earnings announcements and updates on product development, as well as positive analyst sentiment. Other contributing factors include an increase in the number of institutional investors, strong financial results, and an improved competitive landscape. With strong fundamentals and an optimistic outlook for the future, AXON is well-positioned for continued success in the long-term.

Recent Posts