Avon Protection dividend – Avon Protection PLC Announces 0.306 Cash Dividend

February 2, 2023

Dividends Yield

Avon Protection dividend – Avon Protection ($LSE:AVON) PLC recently announced that it will be issuing a 0.306 cash dividend on February 1, 2023. AVON PROTECTION has been a reliable dividend stock, having issued a 0.45 USD dividend per share for the past three years, giving a dividend yield of 3.55% annually from 2020 to 2022. This average dividend yield is quite impressive and should not be overlooked by investors who are interested in investing in dividend stocks. AVON PROTECTION is a global leader in the design, manufacture and supply of respiratory protection products and solutions for military, civil and hazardous environment markets. Its products are designed to protect against chemical, biological, radiological and nuclear (CBRN) threats and are used by militaries and first responders worldwide.

The company’s products are also widely used in the industrial, healthcare and commercial markets. If you’re looking to invest in dividend stocks, AVON PROTECTION should be added to your list. The ex-dividend date for this stock is February 9th 2023, so make sure you keep that in mind when making your investments. Investing in dividend stocks can be a great way to build wealth over the long term, so don’t miss out on the opportunity to add AVON PROTECTION to your portfolio.

Market Price

This is the first time that the company has issued a dividend since its inception. At the same time, its stock opened at £10.1 and closed at the same price, down by 0.2% from its last closing price of 10.1. Its products are designed to provide maximum protection in hostile environments and are trusted by the world’s leading armed forces and security organizations. The dividend announcement is seen as a sign of the company’s commitment to its shareholders. The company’s management is optimistic that the dividend will be well-received by shareholders, as it reflects their confidence in the company’s ability to generate consistent returns in the future.

The company’s stock has been performing steadily over the past few months, with a 0.2% drop in its share price on Wednesday being the only notable change. This indicates that investors are confident in the future of Avon Protection PLC, and are willing to invest in the company’s long-term prospects. It shows that the company is committed to rewarding them for their investments, and is willing to reward them for their loyalty with a dividend payout. It also indicates that the company is in a strong financial position and is confident in its ability to generate returns for its investors. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Avon Protection. More…

| Total Revenues | Net Income | Net Margin |

| 271.9 | -7.6 | -2.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Avon Protection. More…

| Operations | Investing | Financing |

| 28.7 | -12.1 | -20.8 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Avon Protection. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 348 | 137.5 | 6.96 |

Key Ratios Snapshot

Some of the financial key ratios for Avon Protection are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 7.3% | -36.8% | -1.0% |

| FCF Margin | ROE | ROA |

| 7.3% | -0.8% | -0.5% |

Analysis

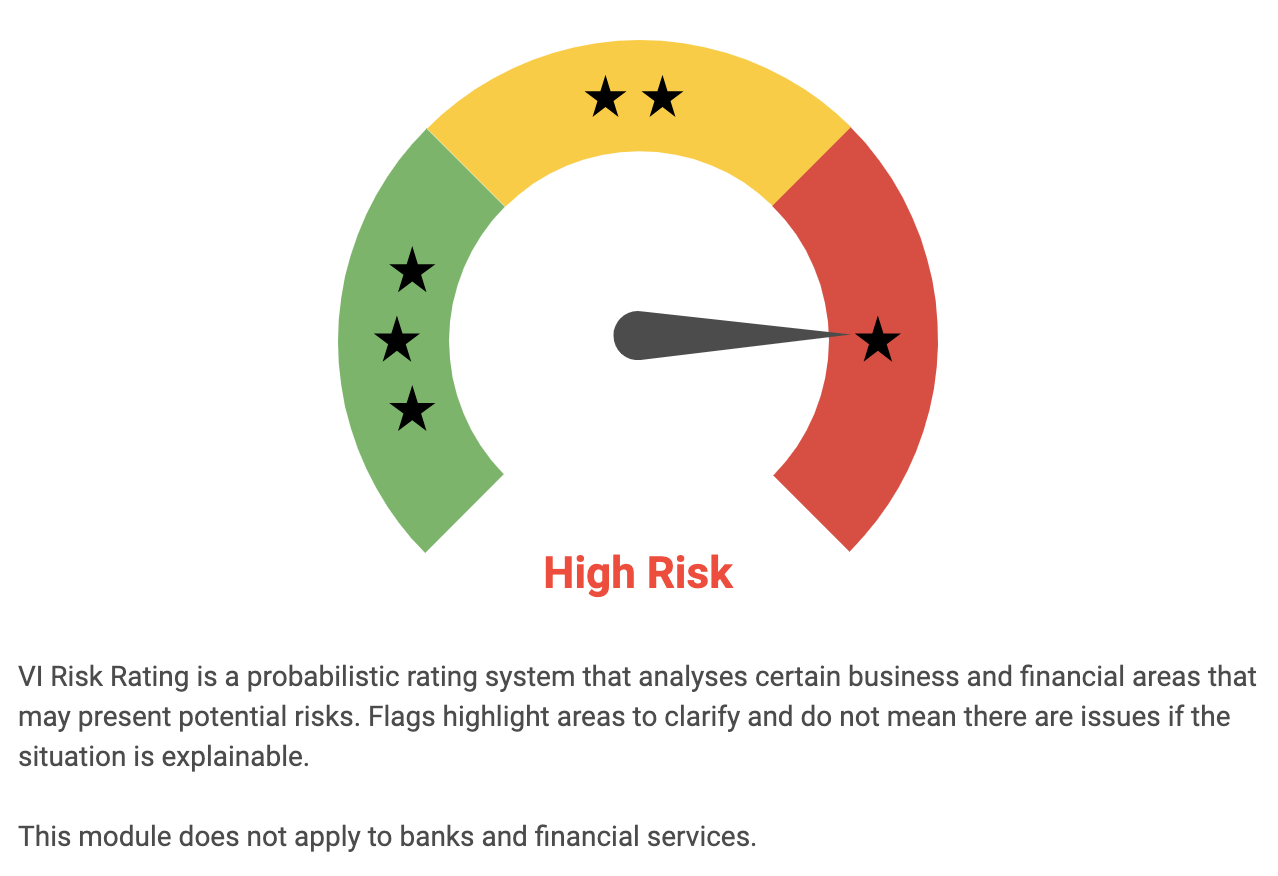

GoodWhale conducted an in-depth analysis of AVON PROTECTION‘s fundamentals, and based on its Risk Rating, the company is considered a high risk investment. GoodWhale has highlighted two risk warnings in both the income sheet and balance sheet; this means that there are certain areas of the company that present a higher risk as compared to other companies in the same industry. The analysis conducted by GoodWhale provides an objective evaluation of the company, helping investors make more informed decisions. GoodWhale’s Risk Rating provides investors with an in-depth look at the overall risk of the company, allowing them to make the best possible decision when it comes to investing. GoodWhale also provides investors with detailed reports on the company’s financials and business operations. This information can help investors identify potential risks and opportunities within the company. Overall, GoodWhale’s analysis of AVON PROTECTION’s fundamentals can help investors make informed decisions on whether or not to invest in the company. To access the full report and risk rating of AVON PROTECTION, register on goodwhale.com. More…

Peers

The competitive landscape of the global military CBRN protection market is marked by the presence of a large number of small and medium-sized companies. The key players in the market are Avon Protection PLC, Electro Optic Systems Hldgs Ltd, OHB SE, and Hindustan Aeronautics Ltd. These companies hold a significant share in the global market.

– Electro Optic Systems Hldgs Ltd ($ASX:EOS)

Electro Optic Systems Holdings Ltd is an Australian technology company that provides aerospace and defence products and services. It has a market capitalisation of $87.33 million as of 2022 and a return on equity of -21.32%. The company designs, develops, manufactures and sells a range of electro-optic products and systems for military, government and commercial applications. Its products include night vision goggles, thermal imaging cameras, laser rangefinders, laser pointers and laser jammers.

– OHB SE ($LTS:0FH7)

The company’s market cap is $500.86M as of 2022 and its ROE is 13.17%. The company is involved in the business of providing health and beauty products and services.

– Hindustan Aeronautics Ltd ($BSE:541154)

Hindustan Aeronautics Ltd. is an Indian state-owned aerospace and defence company based in Bangalore, Karnataka. It is governed by the Ministry of Defence of the Government of India. The company is primarily involved in the operations of the Indian Air Force, Indian Navy, and the Indian Coast Guard.

Summary

AVON PROTECTION is a dividend stock with an average dividend yield of 3.55%, making it an attractive option for income investors. The company has been consistently paying a dividend of 0.45 USD per share for the past three years, and the ex-dividend date for this stock is February 9 2023. From a fundamental perspective, AVON PROTECTION has a good track record of consistent dividend payments and a stable history of performance.

Analysts are bullish on the stock, as the company has managed to deliver strong returns despite the economic downturn over the past few years. With a solid dividend yield and a bright future outlook, AVON PROTECTION is an attractive investment option for those looking to diversify their portfolio and generate additional income.

Recent Posts