Aar Corp Stock Fair Value Calculator – John Mcclain Holmes III Unloads 20767 Shares of AAR Corp. Stock

January 28, 2023

Trending News ☀️

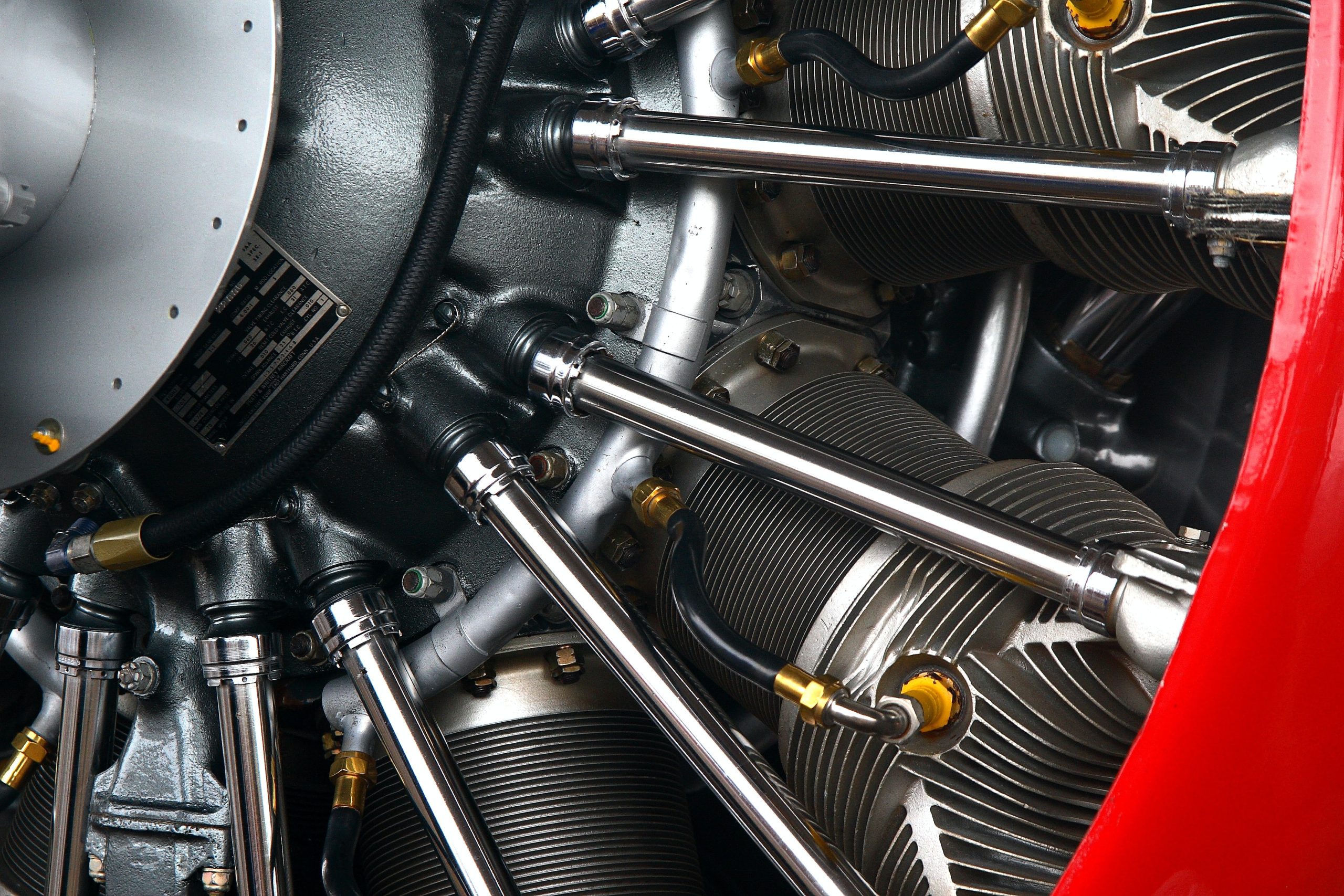

Aar Corp Stock Fair Value Calculator – John Mcclain Holmes III recently unloaded 20767 shares of AAR ($NYSE:AIR) Corp. stock, representing a significant decrease in his ownership of the company. The company provides services such as parts supply and overhaul and repair, inventory management and logistics services, and engineering and technical services. It is also publicly traded on the New York Stock Exchange under the symbol AIR. Given AAR Corp.’s performance and strength in the aviation services industry, it is unclear why John Mcclain Holmes III has chosen to unload his shares in the company.

However, it is likely that he has decided to diversify his portfolio or move his investments elsewhere. Whatever his reasons may be, his decision to sell 20767 shares of AAR Corp. stock represents a significant decrease in his ownership of the company.

Price History

The news of this move has been mostly positive, as the AAR Corp. stock opened at $48.1 and closed at $48.2, up by 0.1% from its last closing price of 48.2. This indicates that investors have confidence in the company’s future prospects and growth potential. The move to sell these shares was likely motivated by the company’s long-term strategy. AAR Corp. has been focused on providing innovative solutions to the aviation industry through its comprehensive portfolio of products and services. It has also been actively engaged in research and development, and is a leader in the areas of aircraft maintenance, parts, and logistics.

The sale of 20767 shares of AAR Corp. stock could be seen as a sign that John Mcclain Holmes III is confident in the future success of the company and its ability to generate returns for its investors. Overall, the sale of 20767 shares of AAR Corp. stock is good news for investors as it shows that the company is doing well and has long-term potential for growth. It is also reassuring to see an insider unloading shares, as it shows that they are confident in the future of the company. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Aar Corp. More…

| Total Revenues | Net Income | Net Margin |

| 1.84k | 90.6 | 5.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Aar Corp. More…

| Operations | Investing | Financing |

| 16.7 | -32.1 | 20.3 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Aar Corp. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 1.65k | 611.6 | 30.05 |

Key Ratios Snapshot

Some of the financial key ratios for Aar Corp are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -5.6% | 5.4% | 6.9% |

| FCF Margin | ROE | ROA |

| -0.4% | 7.7% | 4.8% |

VI Analysis – Aar Corp Stock Fair Value Calculator

AAR Corp is a company with great long-term potential as indicated by its fundamentals. The VI Line analysis has revealed that the intrinsic value of AAR Corp’s stock is around $37.5, which is lower than the current market price of $48.2, implying that the stock is currently overvalued by around 29%. Investors should consider this information before investing in AAR Corp. It is important to note that, although the current stock price is overvalued, it does not necessarily mean that the stock is a bad investment. It could be an opportunity for investors to buy the stock at a discounted price, in anticipation of a potential increase when the stock reaches its intrinsic value. In addition, investors should also consider the company’s financials and long-term prospects before investing. Overall, AAR Corp has the potential to be a good investment in the long run and VI Line’s analysis provides investors with an indication of the company’s intrinsic value. Investors should take this into account when deciding whether or not to invest in AAR Corp. More…

VI Peers

The aerospace industry is highly competitive, with companies vying for contracts from airlines and governments around the world. Its competitors include Sichuan Haite High-tech Co Ltd, Destini Bhd, Embraer SA, and other large aerospace firms. AAR Corp has a strong track record of delivering quality products and services, and is well-positioned to continue its success in the years to come.

– Sichuan Haite High-tech Co Ltd ($SZSE:002023)

Sichuan Haite High-tech Co Ltd is a Chinese company that manufactures and sells a variety of products, including semiconductors, integrated circuits, and other electronic components. The company has a market cap of 6.96B as of 2022 and a Return on Equity of 0.16%.

– Destini Bhd ($KLSE:7212)

Destini Bhd is a Malaysian company that provides engineering solutions. The company has a market capitalization of 133.08 million as of 2022 and a return on equity of 1.97%. Destini Bhd’s main business activities include providing engineering solutions for the aerospace, oil and gas, and defense industries. The company also has a joint venture with Airbus Group to provide engineering solutions for the A320neo aircraft.

– Embraer SA ($NYSE:ERJ)

Embraer SA is a Brazilian aerospace conglomerate that manufactures aircraft and provides aviation services. The company has a market cap of 1.93B as of 2022 and a return on equity of 4.38%. Embraer is the world’s third-largest producer of commercial jets, and its products are used by airlines around the globe. The company has a strong presence in the regional jet market, and its products are known for their fuel efficiency and reliability. Embraer has a long history of innovation, and its products are some of the most advanced in the aviation industry. The company is a major player in the global aerospace market, and its products are used by many of the world’s leading airlines.

Summary

Investing in AAR Corp. (AIR) has shown positive returns in recent months, with the stock price rising steadily. Recent news that John Mcclain Holmes III unloaded 20767 shares of AAR Corp. stock has not affected the share price, indicating investors remain confident in the stock. Analysts continue to view AAR Corp. as a good long-term investment with the potential for future growth.

The company offers a diverse portfolio of products and services, with a strong presence in the aerospace, aviation and defense industries. AAR Corp. has a long history of successfully adapting to changing market conditions and has a positive outlook for the future. With a strong balance sheet and cash position, AAR Corp. is well-positioned to take advantage of potential opportunities in the market.

Recent Posts