Troika Media Stock Intrinsic Value – Troika Media Announces Nasdaq Determines Delisting of Securities

May 19, 2023

Trending News ☀️

Troika Media ($NASDAQ:TRKA) recently announced that Nasdaq has determined that its securities are to be delisted. This news comes after an extensive review of the company’s financial and operational performance that concluded the company is not in compliance with Nasdaq listing standards. Troika Media is a media and information services company that provides advertising, marketing and communications services. They specialize in helping companies increase their online presence, as well as providing audience growth strategies. They also provide highly targeted, localized marketing campaigns to optimize customer engagement. With a strong suite of digital solutions, they offer a comprehensive range of services to meet the needs of their clients across industries. The news of the delisting of Troika Media’s securities by Nasdaq has caused a stir in the investment community and has caused some shareholders to question their investment decisions.

The company has requested a hearing before the Nasdaq Hearings Panel to review the delisting determination. The hearing will determine whether or not the Nasdaq should suspend trading of Troika Media’s securities and if so, for how long. Troika Media is actively working to address the issues that led to the delisting determination. They are confident they will be able to resolve the issues in a timely fashion and restore investor confidence. In the meantime, they are committed to providing their clients with the best service possible and continuing on with business operations as usual.

Share Price

TROIKA MEDIA made a public announcement on Thursday that the Nasdaq has determined to delist their securities. This news caused their stock to open at $0.2 and close at $0.2, a 14.2% decrease from its prior closing price of $0.2. The company has also announced that they plan to appeal the Nasdaq’s decision to the Nasdaq Hearings Panel. The delisting of TROIKA MEDIA’s securities is due to their failure to comply with the minimum requirements of market value of publicly held shares and shareholders’ equity as laid out in Nasdaq’s listing rules. As a result, the company’s failure to meet these requirements has caused Nasdaq to determine the delisting of their securities.

The delisting of their securities could have severe implications for TROIKA MEDIA and their stockholders as they are no longer listed on the Nasdaq exchange. Shareholders of the company may have difficulty liquidating their shares as trading in the over-the-counter markets is often less liquid. The company also cautions investors that the delisting of their securities may affect the market price and liquidity of their securities. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Troika Media. More…

| Total Revenues | Net Income | Net Margin |

| 288.98 | -42.02 | -8.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Troika Media. More…

| Operations | Investing | Financing |

| 1.01 | -83.61 | 107.07 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Troika Media. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 155.22 | 124.74 | 0.22 |

Key Ratios Snapshot

Some of the financial key ratios for Troika Media are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 41.8% | – | -11.4% |

| FCF Margin | ROE | ROA |

| 0.3% | -93.9% | -13.3% |

Analysis – Troika Media Stock Intrinsic Value

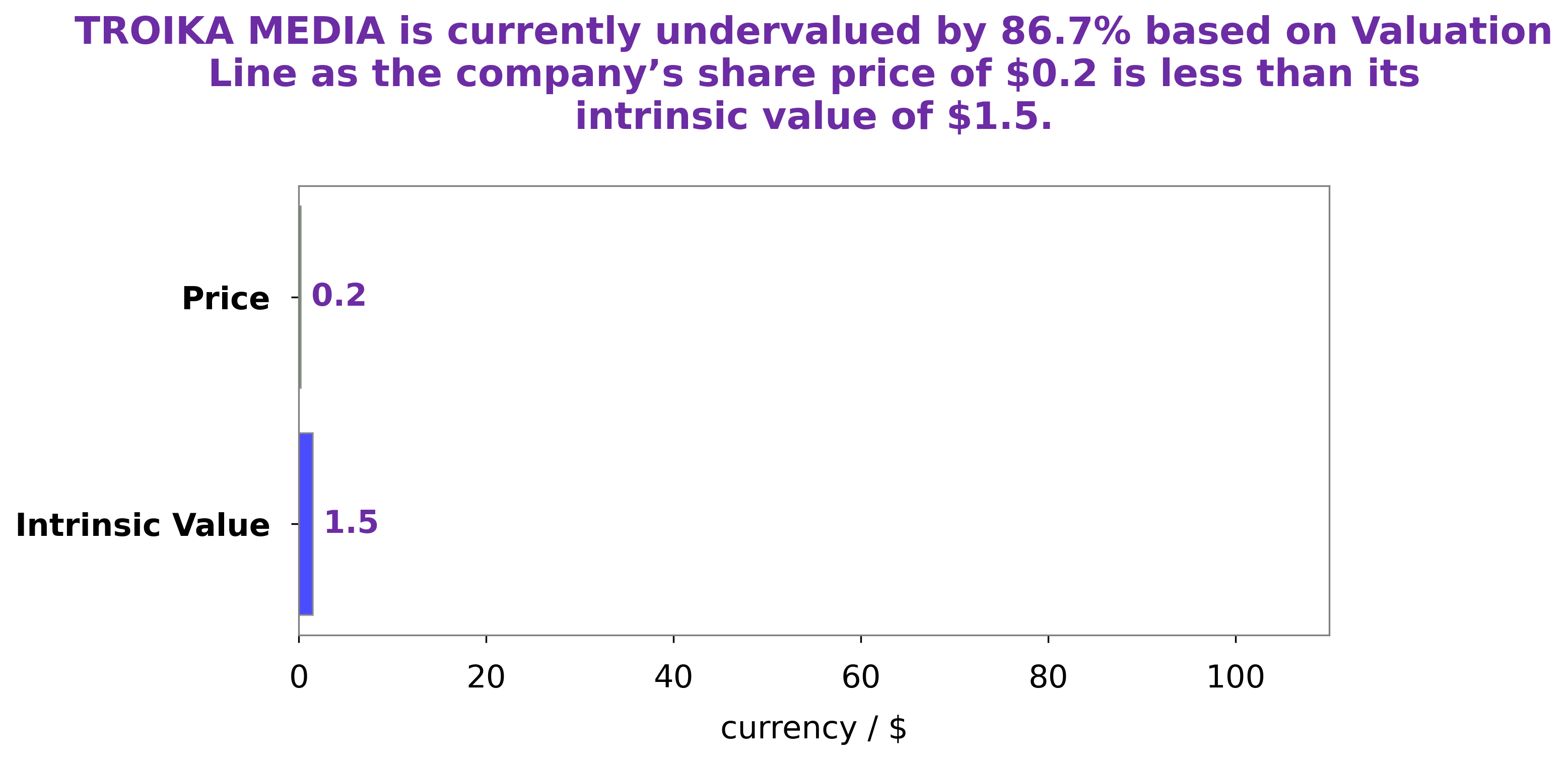

Recently, GoodWhale conducted an analysis of TROIKA MEDIA‘s wellbeing. We found that the intrinsic value of TROIKA MEDIA’s share is around $1.5, as calculated by our proprietary Valuation Line. Unfortunately, the current market value of TROIKA MEDIA stock is traded at $0.2, which is 86.3% lower than the intrinsic value. This indicates that TROIKA MEDIA stocks are currently undervalued. More…

Peers

Troika Media Group Inc is an influential media and entertainment company that has been in operation for over a decade. It competes in the industry with four other companies: Threes Company Media Group Co Ltd, FS Development Investment Holdings, Baosheng Media Group Holdings Ltd, and other key industry players. These companies all provide unique services, ensuring healthy competition in the industry.

– Threes Company Media Group Co Ltd ($SHSE:605168)

Threes Company Media Group Co Ltd is a media and entertainment company based in Hong Kong. As of 2023, the company has a market capitalization of 13.37 billion and a Return on Equity of 22.63%. This indicates that the company has been successful in generating profits from their investments. The company produces and distributes TV, film and music content around the world. They also invest in various content related businesses such as production, distribution, licensing, and marketing. In addition, they provide services in the areas of digital marketing, advertising, promotions, branding, and more. Threes Company Media Group Co is a large player in the media and entertainment industry and their market capitalization and Return on Equity are a testament to their success.

– FS Development Investment Holdings ($SZSE:300071)

FSDI Investment Holdings is a financial services holding company listed on the Johannesburg Stock Exchange. Specializing in investments, risk management, asset management and financial services, it serves as a financial services hub for the Southern African region. Currently, FSDI has a market capitalization of 3.97 billion USD, making it one of the largest financial services companies in the region. The firm has a negative return on equity (ROE) of -10.5%, indicating that it is not currently generating a profit. This is likely due to the high levels of investment and risk management it engages in, as well as the costs associated with providing financial services in the region.

– Baosheng Media Group Holdings Ltd ($NASDAQ:BAOS)

Baosheng Media Group Holdings Ltd is a media and entertainment company that provides television programs, radio broadcasts, and other content across multiple platforms. The company has a market cap of 10.88M as of 2023, indicating its relatively small size in the market. Additionally, its Return on Equity (ROE) of -27.43% indicates the company is not generating a return on its investment and may be in need of improvement.

Summary

Troika Media is an investing analysis firm that provides insights on the Nasdaq stock exchange. They specialize in providing investors with critical information that will help them make informed decisions when it comes to their investments. Troika Media’s analysis focuses on understanding the Nasdaq and the potential for delisting of securities. They also keep a close eye on stock prices and movements, allowing investors to stay up-to-date on what is going on in the markets.

With their insights, investors can anticipate any sudden changes in the stock market and adjust their portfolio accordingly. In short, Troika Media provides invaluable assistance to investors who need help navigating the Nasdaq markets and making smart decisions regarding their investments.

Recent Posts