Short Interest in Deluxe Co. Surges 9.1% in December

January 6, 2023

Trending News ☀️

DELUXE CORPORATION ($NYSE:DLX) is a financial services company based in St. Paul, Minnesota. It provides businesses with check-printing and business services, as well as digital payment and marketing solutions. The company’s stock is listed on the New York Stock Exchange (NYSE: DLX). In December, the short interest in Deluxe Co. rose by 9.1%, indicating a notable surge in the amount of short positions taken on its shares. Short interest is a measure of the total number of shares investors have sold short as a percentage of the company’s total outstanding shares. In this case, the 9.1% increase in short interest could indicate that investors are betting against the stock and expecting it to decline in value in the near future. The surge in short interest could be attributed to a variety of factors. The company recently released its third-quarter earnings report, which included an 18% decline in revenue compared to the same period last year. This could indicate that investors are bearish on the stock and expect further declines in the future.

However, despite the recent surge in short interest, analysts remain bullish on Deluxe Co.’s long-term prospects. The company recently acquired Xero, a digital payments and banking platform, which will help it expand its digital payment offerings and grow its customer base.

Additionally, Deluxe Co. has partnered with various banks to offer digital payment and business services, which could help it capture additional market share. Overall, the recent surge in short interest in Deluxe Co. could indicate that some investors are bearish on the stock and expect it to decline in value in the near future. However, analysts remain optimistic about the company’s long-term prospects and believe that its investments in digital payments and banking could help it capture additional market share and drive growth over the long term.

Stock Price

Investors have been showing a lot of interest in Deluxe Corporation as short interest surged 9.1% in December. So far, the media sentiment has mostly been positive. On Wednesday, Deluxe Corporation stock opened at $18.4 and closed at $18.7, up by 2.9% from the previous closing price of $18.2. This marks an increase in investor confidence as the stock price has been steadily rising for the past few months. The surge in short interest could be attributed to investors expecting higher returns from Deluxe Corporation. The company has made significant investments in technology, which could be fueling the increasing investor confidence.

Additionally, Deluxe Corporation has also been focusing on expanding its product portfolio and services, which further strengthens its position in the market. The increase in short interest could also be attributed to the fact that Deluxe Corporation is one of the largest players in the check and financial services industry. The company has a strong presence in the banking sector and is well-known for its reliable services. This could be another factor driving the surge in short interest. The increasing short interest in Deluxe Corporation indicates that investors are becoming more confident in the long-term prospects of the company. The stock is expected to continue its upward trajectory and could be a lucrative investment for those looking for long-term gains. It is a good sign that investors are taking note of the company’s strong fundamentals and are betting on its success. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Deluxe Corporation. More…

| Total Revenues | Net Income | Net Margin |

| 2.24k | 60.16 | 4.9% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Deluxe Corporation. More…

| Operations | Investing | Financing |

| 185.01 | -79.59 | -148.22 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Deluxe Corporation. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 2.96k | 2.36k | 13.95 |

Key Ratios Snapshot

Some of the financial key ratios for Deluxe Corporation are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 3.7% | -11.0% | 7.4% |

| FCF Margin | ROE | ROA |

| 3.6% | 18.3% | 3.7% |

VI Analysis

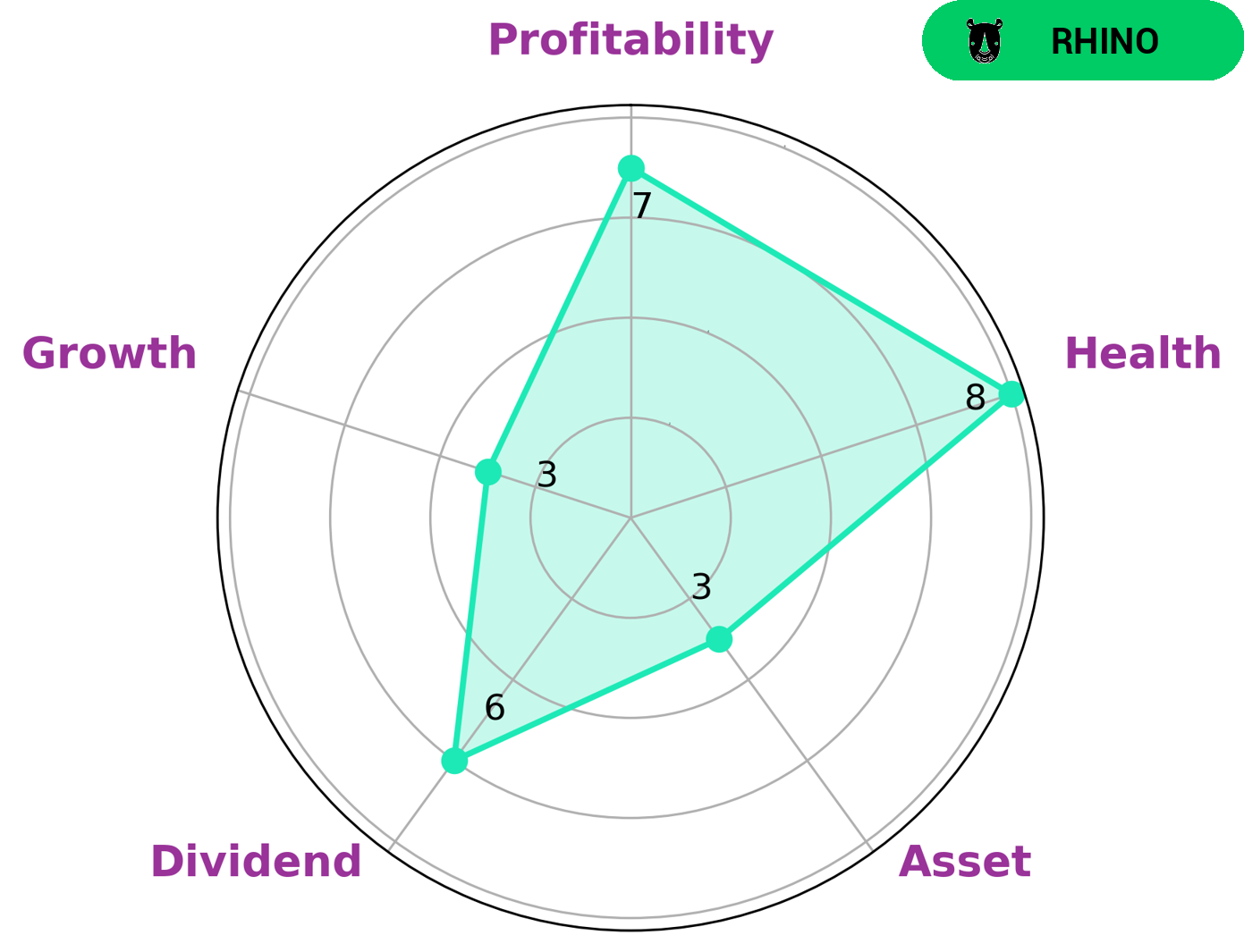

The fundamentals of a company are essential in reflecting its long term potential and can be easily evaluated by the VI app. Based on the VI Star Chart, Deluxe Corporation has a high health score of 8/10, suggesting that it is well-positioned to weather any crisis without the risk of bankruptcy. Deluxe Corporation has been classified as a ‘rhino’, a type of company that has achieved moderate revenue or earnings growth. Investors interested in such companies may be looking for stability and reliability, as well as a good return on their investment. From a financial perspective, Deluxe Corporation is strong in profitability and weak in asset growth. It has also shown moderate success in terms of dividend payments. This suggests that investors should be looking for a solid return on their investment in the form of dividends and capital gains. In conclusion, Deluxe Corporation has a strong health score and moderate revenue and earnings growth. This makes it an attractive option for investors seeking stability and reliability, as well as a good return on their investment. Therefore, investors with medium to long-term investment goals should consider this company as a potential option. More…

VI Peers

Deluxe Corp is in the business of providing software solutions. Its competitors are Ilkka Oyj, Specificity Inc, and DM Solutions Co Ltd.

– Ilkka Oyj ($LTS:0IGW)

Ilkka Oyj is a Finnish company that produces and supplies wood products. It has a market cap of 110.82M as of 2022 and a Return on Equity of 2.9%. The company is involved in the production of lumber, pulp, paper, and energy. It also provides services related to forestry, real estate, and environmental protection.

– Specificity Inc ($OTCPK:SPTY)

Based in New York, Specificity Inc is a biotechnology company that focuses on the development of cancer treatments. The company has a market capitalization of 11.71 million as of 2022 and a return on equity of 189.94%. Specificity Inc’s products are designed to target specific types of cancer cells, which the company believes will result in more effective and less toxic treatments. In addition to its cancer treatments, Specificity Inc is also developing treatments for other diseases, such as Alzheimer’s disease and Parkinson’s disease.

– DM Solutions Co Ltd ($TSE:6549)

The company’s market cap as of 2022 is 2.39B, and its ROE is 5.37%. The company provides software development services and solutions.

Summary

Deluxe Corporation is an American financial services and communications company based in Shoreview, Minnesota. The company has seen a surge in short interest in the month of December, with short interest rising by 9.1%. Overall, the media sentiment towards the company has been largely positive. Investors may find Deluxe Corporation attractive due to its strong revenue growth and strong earnings outlook.

Additionally, Deluxe Corporation has a strong balance sheet and a low debt-to-equity ratio. These factors combined make Deluxe Corporation an attractive option for investors.

Recent Posts