Omnicom Group Intrinsic Value – OMNICOM GROUP Shares Surge Despite Reasonable Valuation

April 26, 2023

Trending News ☀️

The OMNICOM GROUP ($NYSE:OMC) is one of the leading global advertising and marketing communications companies in the world. It provides a variety of services to corporate, public sector and nonprofit clients across the globe. Despite its high stock price, it remains an attractive investment opportunity due to its relatively reasonable valuation. In recent months, OMNICOM GROUP shares have surged significantly.

Despite these gains, investors should not be dissuaded from buying into OMNICOM GROUP due to its reasonable valuation. Overall, despite a significant increase in its stock price, OMNICOM GROUP remains an attractive investment opportunity due to its reasonable valuation and strong financial position. Investors who are looking for a reliable company to invest in should consider buying into OMNICOM GROUP shares.

Market Price

OMNICOM GROUP, a leading advertising and marketing services company, saw its shares surge despite having a reasonable valuation. On Tuesday, the stock opened at $93.5 and closed at $93.1, a slight decrease of 0.7% from its prior closing price of $93.8. Despite this minor dip in share prices, OMNICOM GROUP has seen significant growth in recent times as investors continue to remain optimistic about its prospects. Analysts have noted that the company is well-positioned to capitalize on the growing demand for digital marketing services and other creative solutions. Moreover, its portfolio of services is broad and diversified, allowing it to capitalize on a variety of opportunities across different markets. This, along with its strong balance sheet and commitment to innovation, has provided investors with a good reason to stay invested in the stock.

In addition, the company has also been making efforts to expand its global presence, which has helped drive further growth in share prices. Its strategic acquisitions of other companies in the sector have provided an additional boost to its growth trajectory. As a result, OMNICOM GROUP shares have seen a steady rise over the past few months, despite its reasonable valuation. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Omnicom Group. More…

| Total Revenues | Net Income | Net Margin |

| 14.32k | 1.35k | 9.5% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Omnicom Group. More…

| Operations | Investing | Financing |

| 948.9 | -56.7 | -1.36k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Omnicom Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 25.24k | 21.24k | 15.47 |

Key Ratios Snapshot

Some of the financial key ratios for Omnicom Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.3% | -0.6% | 15.1% |

| FCF Margin | ROE | ROA |

| 6.1% | 42.5% | 5.4% |

Analysis – Omnicom Group Intrinsic Value

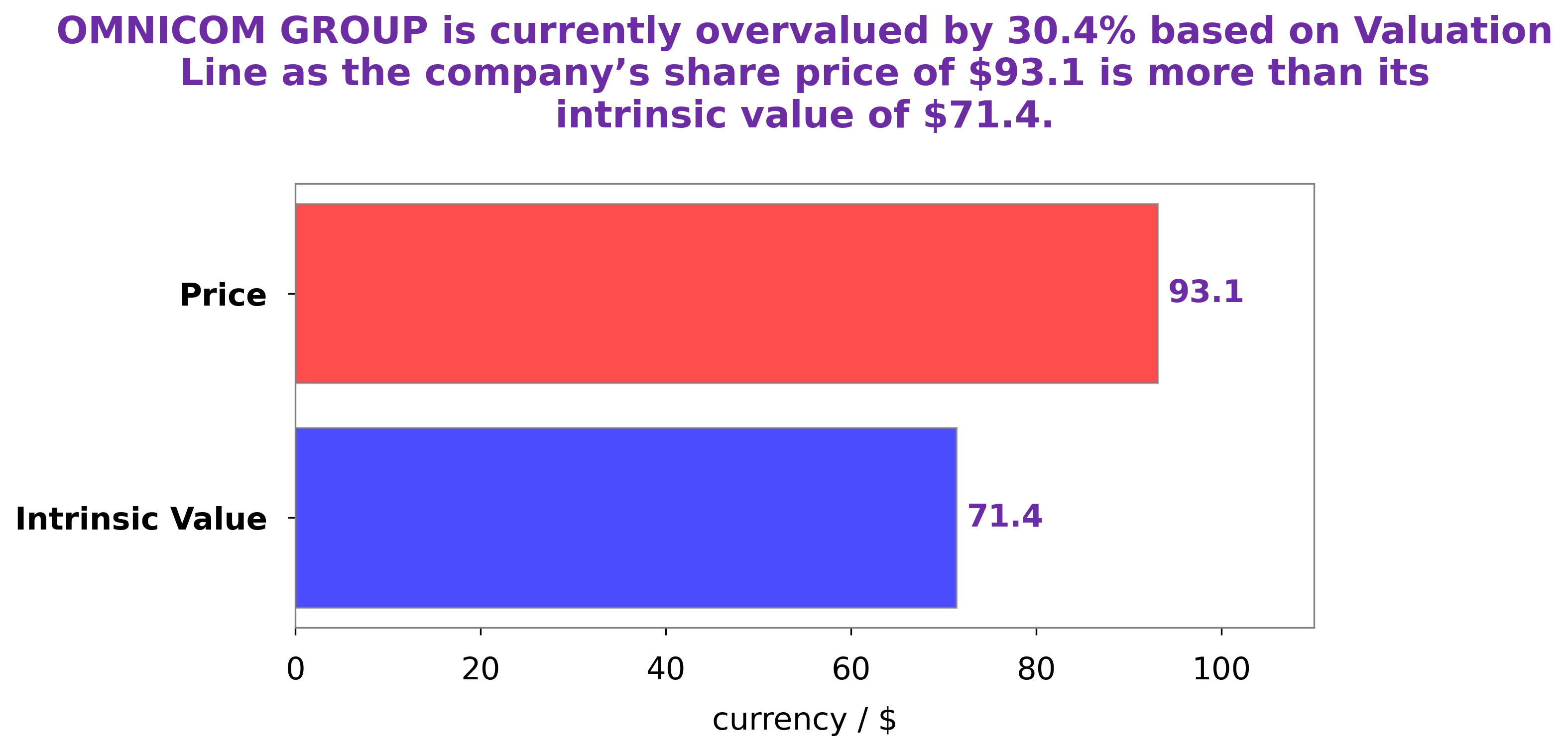

At GoodWhale, we have conducted an analysis of OMNICOM GROUP‘s fundamentals. Our proprietary Valuation Line has calculated the intrinsic value of OMNICOM GROUP share to be around $71.4. Currently, OMNICOM GROUP stock is trading at $93.1, which signifies an overvaluation of 30.4%. This could be an indication of investors expecting the company’s future performance to be better than what our analysis has estimated. More…

Peers

The company was founded in 1886. It operates in more than 100 countries and employs over 70,000 people. Omnicom Group Inc’s competitors include Publicis Groupe SA, WPP PLC, and The Interpublic Group of Companies Inc.

– Publicis Groupe SA ($LTS:0FQI)

Publicis Groupe SA is a French multinational advertising and public relations company headquartered in Paris, France. It is one of the largest advertising holding companies in the world by revenue, and has a presence in over 120 countries. The company provides services to companies and organizations such as media planning, media buying, and public relations. It was founded in 1926 by Marcel Bleustein-Blanchet and is a publicly traded company listed on the Euronext Paris stock exchange.

As of 2022, Publicis Groupe SA had a market capitalization of 14.24 billion euros and a return on equity of 11.95%. The company is a major player in the advertising and public relations industry, with a presence in over 120 countries. It has a long history, dating back to 1926, and is a publicly traded company listed on the Euronext Paris stock exchange.

– WPP PLC ($LSE:WPP)

WPP PLC is a holding company for a group of companies that provide advertising and marketing services. The company has a market cap of 8.1B as of 2022 and a ROE of 21.2%. WPP PLC’s group of companies include Grey Group, Ogilvy & Mather, JWT, and Young & Rubicam. The company has over 200,000 employees in 3,000 offices in 112 countries.

– The Interpublic Group of Companies Inc ($NYSE:IPG)

The Interpublic Group of Companies, Inc. is a holding company that engages in the business of advertising and marketing services through its subsidiaries. The company operates through two segments: Advertising and Marketing Services, and Communications. The Advertising and Marketing Services segment provides advertising, digital marketing, communications planning and media buying, public relations, and specialty communications services. The Communications segment offers public relations, healthcare communications, and investor relations services. The Interpublic Group of Companies was founded in 1902 and is headquartered in New York, New York.

Summary

Omnicom Group is one of the world’s largest advertising conglomerates and is currently trading at a higher price point than it was earlier this year. Despite this, the company is still relatively undervalued in comparison to its peers and the overall market. Investors should consider its consistent dividend payment history, use of debt to increase shareholder returns, and strong long-term growth potential before investing. With a solid track record of increasing revenues, Omnicom Group is an attractive option for investors looking for strong returns.

Recent Posts