Omnicom Group Intrinsic Stock Value – Sequoia Financial Advisors LLC Increases Investment in Omnicom Group in 2023

March 30, 2023

Trending News 🌥️

In 2023, Sequoia Financial Advisors LLC has decided to increase their investment in Omnicom Group ($NYSE:OMC) Inc., a global communications and marketing company. The increased investment shows that Sequoia Financial Advisors LLC believes in the potential and growth of Omnicom Group Inc. With the new injection of capital, Omnicom Group Inc. will be able to expand their global reach and provide services and solutions tailored to their clients’ needs. Omnicom Group Inc. offers a wide range of services, including advertising, public relations, branding, media planning, and digital marketing. With their increased investment from Sequoia Financial Advisors LLC, they will be able to further expand their reach and capabilities.

This will give them an edge over the competition and help them maintain their position as a leader in the communications and marketing industry. With the additional funds, they will be able to expand their services and capabilities while remaining competitive in the global market.

Stock Price

On Monday, Sequoia Financial Advisors LLC announced that it has increased its investment in Omnicom Group Inc. This news was met with a mostly positive response from the public, as evidenced by the stock’s performance on the day of the announcement. At the opening bell, OMNICOM GROUP stock was priced at $88.7 and closed at $88.5, representing a 1.0% increase from its last closing price of 87.6. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Omnicom Group. More…

| Total Revenues | Net Income | Net Margin |

| 14.29k | 1.3k | 9.1% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Omnicom Group. More…

| Operations | Investing | Financing |

| 926.5 | -380.9 | -1.36k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Omnicom Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 27k | 22.84k | 16.04 |

Key Ratios Snapshot

Some of the financial key ratios for Omnicom Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.5% | -0.6% | 15.0% |

| FCF Margin | ROE | ROA |

| 5.9% | 44.7% | 5.0% |

Analysis – Omnicom Group Intrinsic Stock Value

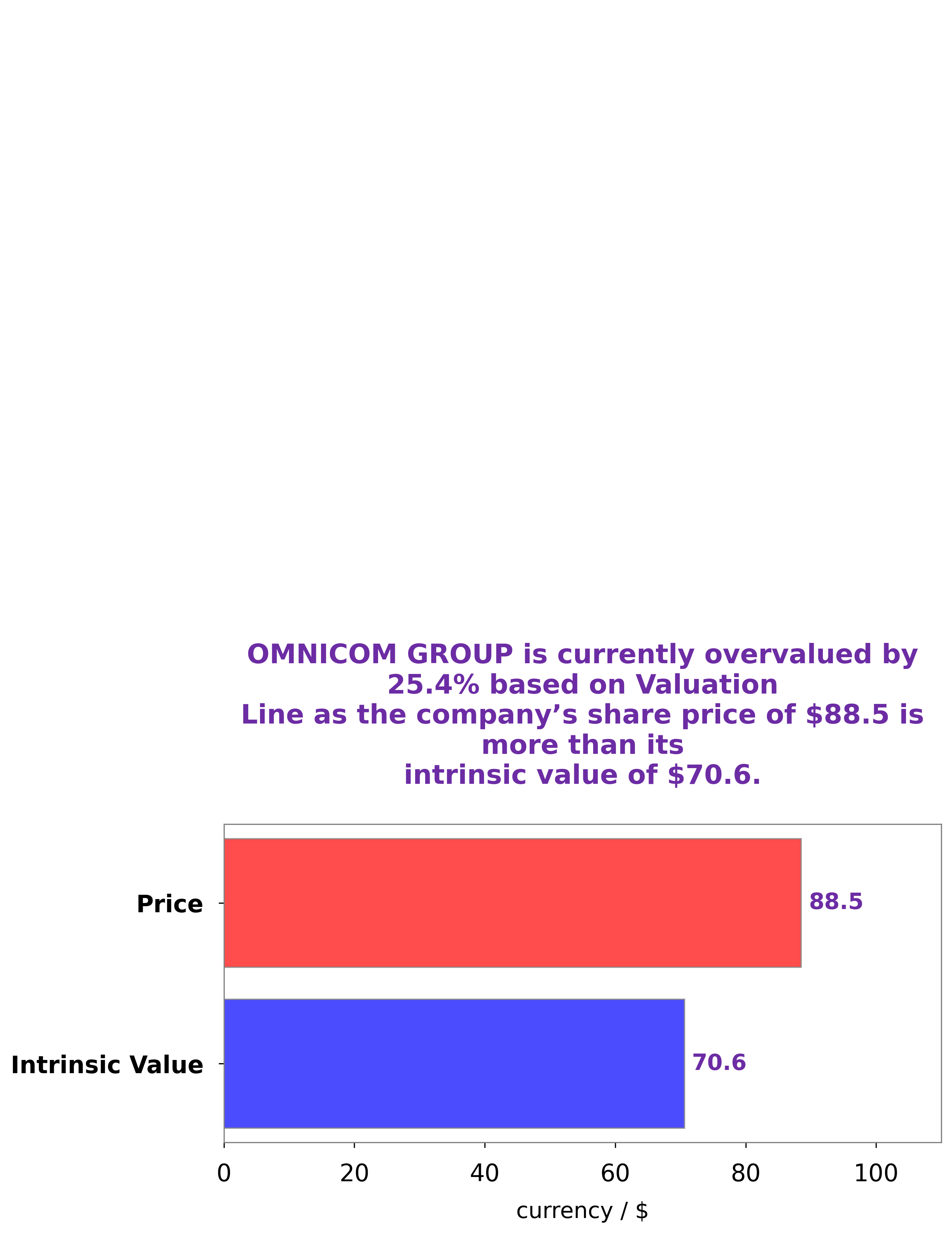

GoodWhale recently completed an analysis of OMNICOM GROUP‘s fundamentals, and our proprietary Valuation Line predicts an intrinsic value of around $70.6. At the time of writing, OMNICOM GROUP shares are trading at $88.5, which is overvalued by 25.3%. This indicates that investors may want to consider taking a closer look at the company’s fundamentals before making any decisions. We believe that the stock has potential to grow over the long term, but investors should ensure that they are comfortable with the risk associated with investing in OMNICOM GROUP before doing so. More…

Peers

The company was founded in 1886. It operates in more than 100 countries and employs over 70,000 people. Omnicom Group Inc’s competitors include Publicis Groupe SA, WPP PLC, and The Interpublic Group of Companies Inc.

– Publicis Groupe SA ($LTS:0FQI)

Publicis Groupe SA is a French multinational advertising and public relations company headquartered in Paris, France. It is one of the largest advertising holding companies in the world by revenue, and has a presence in over 120 countries. The company provides services to companies and organizations such as media planning, media buying, and public relations. It was founded in 1926 by Marcel Bleustein-Blanchet and is a publicly traded company listed on the Euronext Paris stock exchange.

As of 2022, Publicis Groupe SA had a market capitalization of 14.24 billion euros and a return on equity of 11.95%. The company is a major player in the advertising and public relations industry, with a presence in over 120 countries. It has a long history, dating back to 1926, and is a publicly traded company listed on the Euronext Paris stock exchange.

– WPP PLC ($LSE:WPP)

WPP PLC is a holding company for a group of companies that provide advertising and marketing services. The company has a market cap of 8.1B as of 2022 and a ROE of 21.2%. WPP PLC’s group of companies include Grey Group, Ogilvy & Mather, JWT, and Young & Rubicam. The company has over 200,000 employees in 3,000 offices in 112 countries.

– The Interpublic Group of Companies Inc ($NYSE:IPG)

The Interpublic Group of Companies, Inc. is a holding company that engages in the business of advertising and marketing services through its subsidiaries. The company operates through two segments: Advertising and Marketing Services, and Communications. The Advertising and Marketing Services segment provides advertising, digital marketing, communications planning and media buying, public relations, and specialty communications services. The Communications segment offers public relations, healthcare communications, and investor relations services. The Interpublic Group of Companies was founded in 1902 and is headquartered in New York, New York.

Summary

Omnicom Group Inc. is a global advertising and marketing communications company, and has recently seen a boost in investment from Sequoia Financial Advisors LLC, who have increased their stakes in the company. News coverage around this investment has so far been mostly positive, and analysis suggests that Omnicom Group Inc. is set to have a successful 2023. The company’s stock has risen recently, with analysts predicting strong returns for investors who purchase it now. Other reports have highlighted Omnicom’s innovative approach to marketing, as well as its effective product development and consumer experience strategies.

Omnicom Group Inc. also offers some of the most competitive pricing in the industry, and continues to showcase the successes of its previous investments. With Sequoia Financial Advisors LLC increasing their investment, Omnicom Group Inc. is likely to experience significant growth in the next year.

Recent Posts