Investing in Omnicom Group in 2023: Is it Worth the Risk?

February 11, 2023

Trending News 🌧️

Omnicom Group ($NYSE:OMC) Inc. is an American multinational advertising, public relations, and marketing company headquartered in New York City. It is one of the “Big Four” agency companies, alongside WPP, Interpublic Group and Publicis. Furthermore, the firm has seen steady improvement in its financial performance, indicating that it could be a good long-term investment. Omnicom Group Inc. has also been focused on expanding its presence globally. The company has made significant investments in technology and infrastructure, creating an integrated network of marketing solutions across the globe that can drive growth and help clients reach more people than ever before.

This has resulted in the company becoming one of the most prominent providers of global advertising, public relations and marketing services. The company has also continued to invest in innovation to ensure that its clients are provided with the latest technologies and services to boost their marketing campaigns. This includes developing new technologies such as artificial intelligence, predictive analytics and voice search optimization that can help clients reach their target audience more effectively and efficiently. Therefore, with a strong track record of consistent financial performance, investments in technology and innovation, increasing global presence and a secure financial position, investing in Omnicom Group Inc. in 2023 could prove to be a wise decision.

Market Price

On Thursday, OMNICOM GROUP stock opened at $93.3 and closed at $93.2, up by 0.4% from last closing price of 92.9. This indicates a positive trend in the company’s stock performance in the eyes of investors and signifies a potential opportunity for those looking to take advantage of low risk investments. Omnicom reported strong financial results for its third quarter, with net income increasing by 8 percent over the prior year’s quarter.

Overall, investing in Omnicom Group Inc. in 2023 appears to be a low-risk endeavor with potential for growth, since the company is thriving financially and has a solid track record of success. With the right strategy, investors could potentially benefit greatly from investing in this company over the next few years. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Omnicom Group. More…

| Total Revenues | Net Income | Net Margin |

| 14.29k | 1.32k | 9.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Omnicom Group. More…

| Operations | Investing | Financing |

| 1.46k | -709.2 | -1.39k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Omnicom Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 24.13k | 20.49k | 13.47 |

Key Ratios Snapshot

Some of the financial key ratios for Omnicom Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.5% | -0.6% | 15.1% |

| FCF Margin | ROE | ROA |

| 5.4% | 49.0% | 5.6% |

Analysis

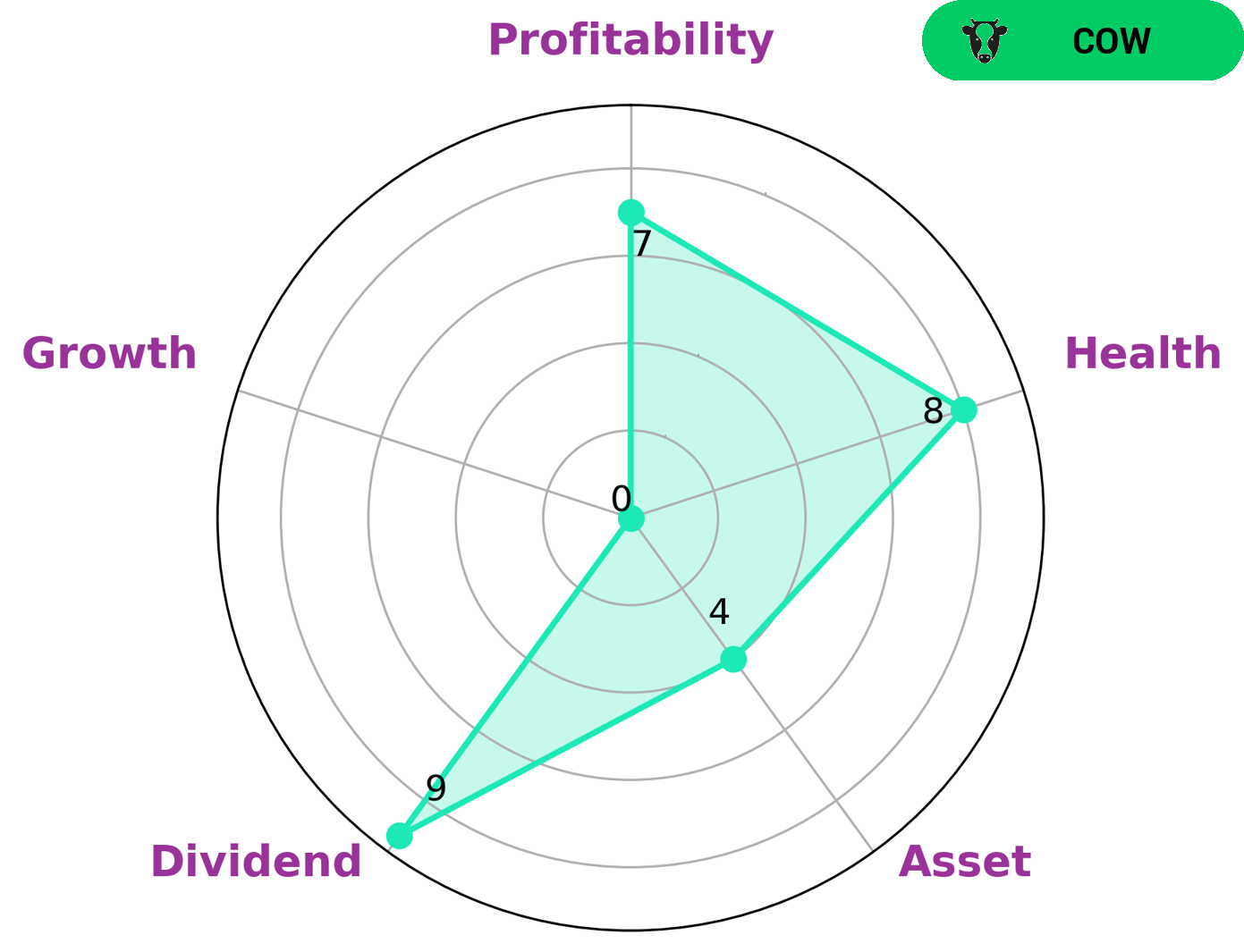

GoodWhale conducted an analysis of OMNICOM GROUP‘s wellbeing and found that according to the Star Chart, the company is classified as a ‘cow’, indicating that it has a track record of paying out consistent and sustainable dividends. Investors who may be interested in OMNICOM GROUP are those who prioritize steady income and are looking for a reliable asset that produces a steady return. In terms of health, the company scored 8/10 as it is capable of paying off debt and funding future operations. Its cashflows and debt are strong and it is categorized as having a high dividend, strong profitability, medium asset quality, and weak growth. This suggests that the company has a reliable income stream and could be a good choice for those interested in steady returns over time. Overall, the analysis conducted by GoodWhale on OMNICOM GROUP’s wellbeing highlighted its ability to provide consistent, reliable dividends. The company is strong in dividend, profitability, medium in asset and weak in growth, making it an ideal asset for those looking to generate a steady return on their investment. More…

Peers

The company was founded in 1886. It operates in more than 100 countries and employs over 70,000 people. Omnicom Group Inc’s competitors include Publicis Groupe SA, WPP PLC, and The Interpublic Group of Companies Inc.

– Publicis Groupe SA ($LTS:0FQI)

Publicis Groupe SA is a French multinational advertising and public relations company headquartered in Paris, France. It is one of the largest advertising holding companies in the world by revenue, and has a presence in over 120 countries. The company provides services to companies and organizations such as media planning, media buying, and public relations. It was founded in 1926 by Marcel Bleustein-Blanchet and is a publicly traded company listed on the Euronext Paris stock exchange.

As of 2022, Publicis Groupe SA had a market capitalization of 14.24 billion euros and a return on equity of 11.95%. The company is a major player in the advertising and public relations industry, with a presence in over 120 countries. It has a long history, dating back to 1926, and is a publicly traded company listed on the Euronext Paris stock exchange.

– WPP PLC ($LSE:WPP)

WPP PLC is a holding company for a group of companies that provide advertising and marketing services. The company has a market cap of 8.1B as of 2022 and a ROE of 21.2%. WPP PLC’s group of companies include Grey Group, Ogilvy & Mather, JWT, and Young & Rubicam. The company has over 200,000 employees in 3,000 offices in 112 countries.

– The Interpublic Group of Companies Inc ($NYSE:IPG)

The Interpublic Group of Companies, Inc. is a holding company that engages in the business of advertising and marketing services through its subsidiaries. The company operates through two segments: Advertising and Marketing Services, and Communications. The Advertising and Marketing Services segment provides advertising, digital marketing, communications planning and media buying, public relations, and specialty communications services. The Communications segment offers public relations, healthcare communications, and investor relations services. The Interpublic Group of Companies was founded in 1902 and is headquartered in New York, New York.

Summary

Investing in Omnicom Group Inc. in 2023 is a decision that may be worth considering. The company has been performing well in the past few years and current news suggests that the trend is likely to continue. Omnicom Group Inc. has a long history of success, offering its clients diverse services, including advertising, media, public relations, and specialty communications. It is a leader in the marketing and communication services industry and has a widespread presence across the US.

The company also has an impressive portfolio of globally recognized clients, ranging from leading technology companies to some of the world’s most popular consumer products. Analysts suggest that diversifying investments in companies with strong fundamentals and attractive growth potential may be the best strategy for long-term success. Omnicom Group Inc. may be a worthwhile consideration for potential investors in 2023.

Recent Posts