Entravision Communications dividend yield – Entravision Communications Corp Announces 0.05 Cash Dividend

March 26, 2023

Dividends Yield

On March 1 2023, Entravision Communications ($NYSE:EVC) Corp announced that they are paying a 0.05 cash dividend to their shareholders. This could be an attractive opportunity for those who are looking to invest in stocks with a good dividend yield. ENTRAVISION COMMUNICATIONS has been providing annual dividends to its shareholders in the past 3 years, with dividends of 0.1 USD in 2020, 0.1 USD in 2021 and 0.12 USD in 2022. The dividend yields from 2020 to 2022 were 1.56%, 1.78% and 7.56%, averaging out to 3.63%.

The ex-dividend date for 2023 was set to be on March 15th. This can be a great opportunity for those who are looking for a reliable dividend yield to invest in.

Stock Price

With this dividend, ENTRAVISION COMMUNICATIONS continues to reward shareholders for their long-term support of the company. The company is committed to delivering value to its shareholders and this cash dividend is a sign of that commitment. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Entravision Communications. More…

| Total Revenues | Net Income | Net Margin |

| 956.21 | 18.12 | 3.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Entravision Communications. More…

| Operations | Investing | Financing |

| 78.92 | -60.49 | -92.82 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Entravision Communications. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 880.84 | 595.47 | 3.13 |

Key Ratios Snapshot

Some of the financial key ratios for Entravision Communications are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 51.8% | 33.7% | 4.5% |

| FCF Margin | ROE | ROA |

| 7.1% | 9.9% | 3.0% |

Analysis

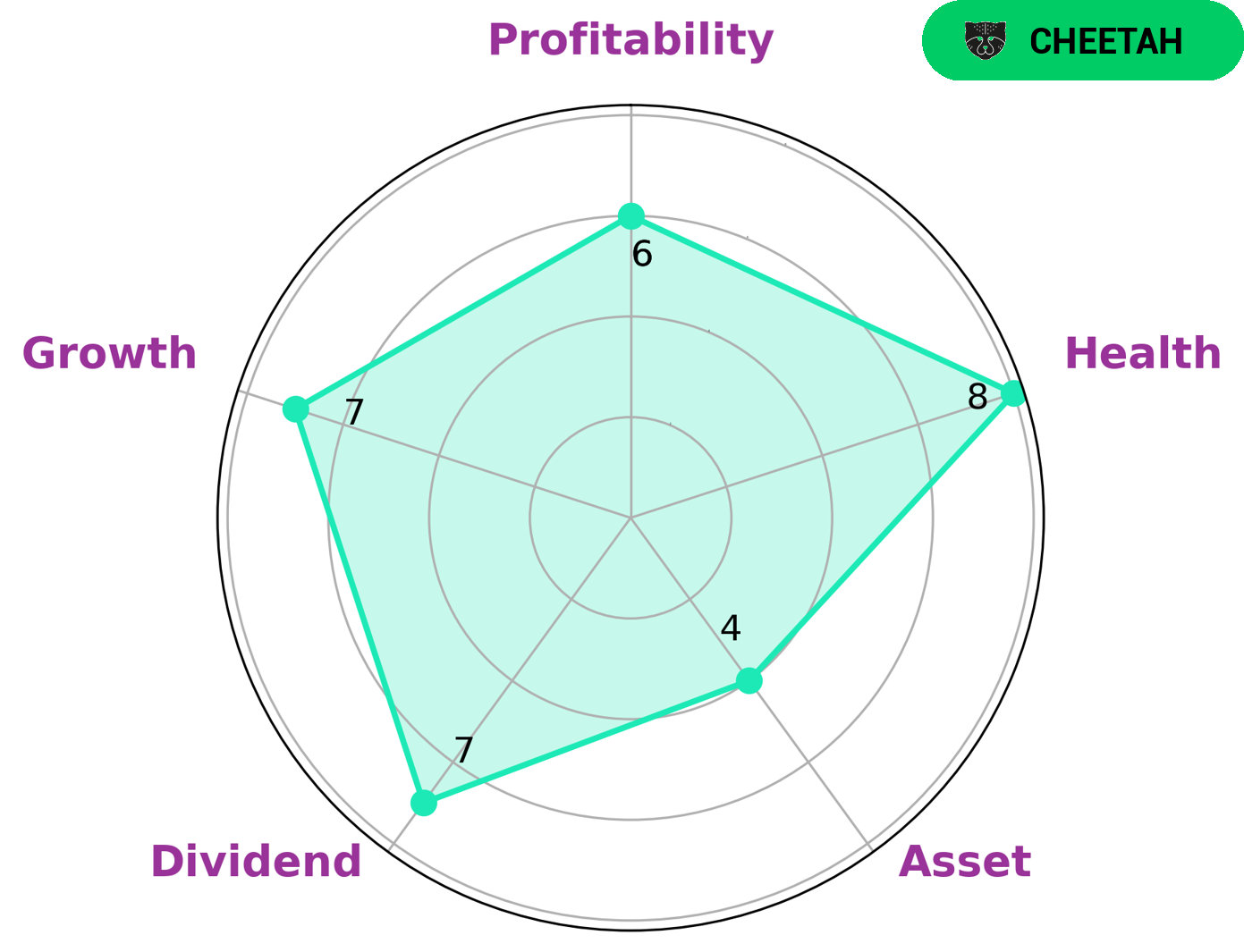

GoodWhale has conducted a thorough analysis of ENTRAVISION COMMUNICATIONS‘ fundamentals and has come to the conclusion that the company has a high health score of 8/10 with regard to its cashflows and debt, indicating it is capable of sustaining future operations in times of crisis. On top of this, ENTRAVISION COMMUNICATIONS is strong in dividend, growth, and medium in asset, profitability. Furthermore, our Star Chart has classified ENTRAVISION COMMUNICATIONS as a ‘cheetah’, a type of company that has achieved rapid revenue or earnings growth but is considered less stable due to low profitability. Investors interested in such a company may be those looking for long-term capital appreciation and are willing to take on higher risk investments. Additionally, these investors should be prepared to monitor their investments more closely since they may be more volatile than other types of companies. More…

Peers

In the world of media and broadcasting, competition is fierce. Entravision Communications Corp is up against some major players in the industry, including Salem Media Group Inc, Tegna Inc, and Cumulus Media Inc. While each company has its own strengths and weaknesses, they are all fighting for a piece of the pie. Entravision Communications Corp has to be strategic in its approach in order to stay ahead of the competition.

– Salem Media Group Inc ($NASDAQ:SALM)

Salem Media Group, Inc. operates as a multi-media company in the United States. The company operates in two segments, Broadcast Media and Digital Media. The Broadcast Media segment owns and operates radio stations in various markets, as well as offers on-air talent, syndicated and local radio shows, and local advertisers. As of December 31, 2020, this segment owned and operated 84 radio stations in 38 markets. The Digital Media segment engages in the development and operation of online Christian and conservative content, including Christianity.com, GodTube.com, OnePlace.com, Crosswalk.com, BibleStudyTools.com, GodVine.com, ChurchLeadership.com, and ChristianJobs.com. This segment also operates SalemSurveys.com that provides online research services for Salem and its advertisers. Salem Media Group, Inc. was founded in 1985 and is headquartered in Camarillo, California.

– Tegna Inc ($NYSE:TGNA)

Tegna Inc is a publicly traded company with a market cap of 4.24B as of 2022. The company’s Return on Equity is 20.09%. Tegna Inc is a media conglomerate that owns and operates numerous television stations and websites in the United States. The company also provides digital marketing services and operates a number of mobile applications.

– Cumulus Media Inc ($NASDAQ:CMLS)

Cumulus Media Inc is a radio broadcasting company that owns and operates radio stations across the United States. The company has a market cap of 138.56M as of 2022 and a Return on Equity of 16.7%. Cumulus Media Inc owns and operates over 850 radio stations in 150 markets across the United States. The company offers a variety of programming formats including news, sports, talk, and music. Cumulus Media Inc is headquartered in Atlanta, Georgia.

Summary

Investing in ENTRAVISION COMMUNICATIONS can be a good option for those looking for stocks with high dividend yield. The company has consistently issued an annual dividend of 0.1-0.12 USD over the past 3 years, translating to an average dividend yield of 3.63%. These strong dividends make ENTRAVISION COMMUNICATIONS an attractive investment option for investors seeking to benefit from regular income.

Recent Posts