Dentsu Group dividend yield – Dentsu Group Announces 78.5 Cash Dividend

June 9, 2023

🌥️Dividends Yield

On June 1 2023, Dentsu Group ($TSE:4324) Inc. announced a 78.5 cash dividend for its shareholders. This dividend continues the company’s consistent dividend policy of 155.25 JPY per share for the last three years, resulting in a steady dividend yield of 3.61%. This dividend makes Dentsu Group Inc. an attractive investment choice for those looking to invest in dividend stocks, with the ex-dividend date being June 29 2023. This announcement has been welcomed by shareholders who have been looking for a solid dividend stock to add to their portfolios.

The company’s consistent and steady dividend policy has been well-received in the market as it provides assurance to shareholders that their investments are safe and their returns are reliable. Furthermore, the long-term stability of the company’s profitability means that investors can count on Dentsu Group Inc. as a long-term investment option.

Market Price

The news caused the company’s stock to open at JP¥4495.0, yet close slightly lower at JP¥4480.0. The dividend is expected to be paid out by the end of this June. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for Dentsu Group. More…

| Total Revenues | Net Income | Net Margin |

| 1.24M | 59.85k | 7.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for Dentsu Group. More…

| Operations | Investing | Financing |

| 80.9k | -24.35k | -188.19k |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for Dentsu Group. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 3.74M | 2.79M | 3.33k |

Key Ratios Snapshot

Some of the financial key ratios for Dentsu Group are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| 5.9% | 23.8% | 11.3% |

| FCF Margin | ROE | ROA |

| 5.0% | 9.8% | 2.4% |

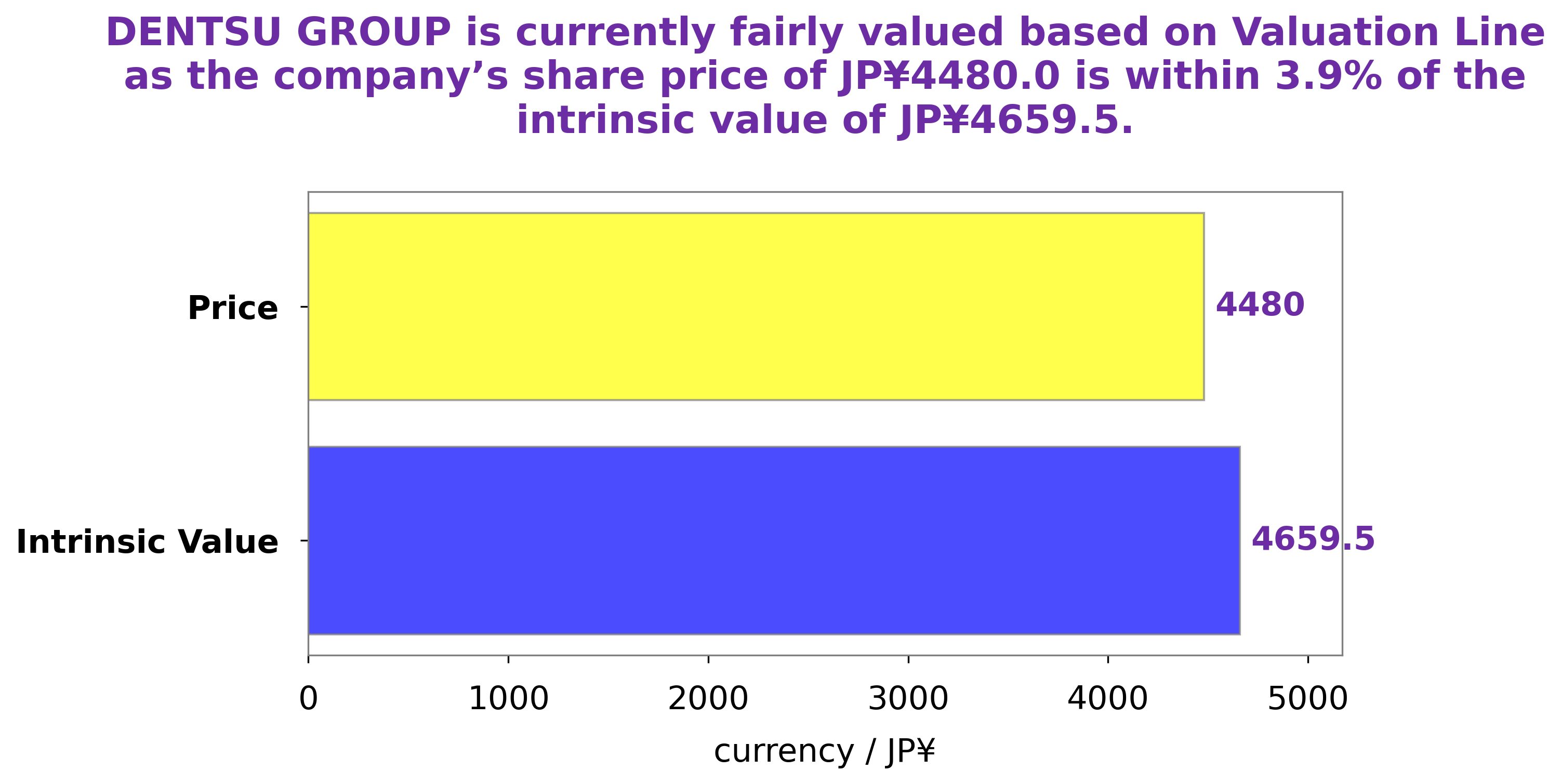

Analysis – Dentsu Group Stock Fair Value Calculation

At GoodWhale, we have conducted an analysis of the financials of DENTSU GROUP. Our proprietary Valuation Line has calculated that the fair value of DENTSU GROUP’s share is approximately JP¥4659.5. Currently, DENTSU GROUP’s stock is being traded at JP¥4480.0, making it a fair price that is slightly undervalued by 3.9%. More…

Peers

Dentsu Group Inc is an international advertising and public relations company with a long history of success in the global market. It is one of the largest advertisement firms in the world and is renowned for its innovative approach to marketing. Its primary competitors are Hakuhodo DY Holdings Inc, Nrj Group, and SinoMedia Holding Ltd, all of which are large-scale advertisement companies with their own unique business strategies.

– Hakuhodo DY Holdings Inc ($TSE:2433)

Hakuhodo DY Holdings Inc is a holding company specializing in advertising and PR services, as well as marketing research and consulting. As of 2023, the company has a market capitalization of 492.18 billion, reflecting its strong financial performance. The company’s return on equity (ROE) stands at 15.68%, which is an indication of its efficient utilization of shareholder funds. The company’s strong financial performance is driven by its diversified portfolio of businesses and the constant demand for advertising and PR services.

– Nrj Group ($BER:NR8)

Nrj Group is a French media company. It is the parent company of Europe’s largest private radio company NRJ, as well as several other radio networks and television channels. As of 2023, its market capitalization stands at 533.77M, reflecting its strong financial performance over the years. The company also has a strong Return on Equity of 4.89%, which shows the good return it provides to its shareholders relative to its equity base. This is a sign of the company’s efficient management and the success of its strategy.

– SinoMedia Holding Ltd ($SEHK:00623)

SinoMedia Holding Ltd is a media and entertainment company based in China. The company is focused on providing content, technology, and services to traditional media, digital media, and other related industries. As of 2023, the company has a market cap of 406.24M. Furthermore, the company has a Return on Equity (ROE) of -1.36%, indicating that the company is not able to generate a profit from its equity investments. This could be a sign of financial distress.

Summary

Investing in DENTSU GROUP is a wise choice as it has been paying out attractive dividend yields of 3.61%, which is significantly higher than the average of the Japanese stock market. The dividends have been steady for the past three years, with a consistent dividend per share at 155.25 JPY. Despite the current volatility of the market, DENTSU GROUP’s strong financial position and steady dividend payouts make it a good investment option for those looking for long-term growth and stability. Additionally, the company’s commitment to innovation, strong customer service, and strategic acquisitions have continued to boost its share price and performance in recent years.

Recent Posts