Clear Channel Outdoor Holdings, Stock Price Soars to $1.33.

January 30, 2023

Trending News ☀️

Clear Channel Outdoor ($NYSE:CCO) Holdings, Inc. is a global company in the out-of-home advertising industry. Their stock price recently soared to $1.33, which is a significant increase from the trading price prior to the surge. The surge in stock price has been attributed to the company’s positive outlook on the future of their industry, as well as their dedication to innovation and technology. The out-of-home advertising industry is expected to experience strong growth over the next few years. Clear Channel Outdoor’s products and services will be at the forefront of this growth. Their innovative products and services are designed to give businesses more control over and insights into their ad campaigns.

This is expected to result in more effective and efficient marketing campaigns for businesses, which will drive revenue for Clear Channel Outdoor. In addition to their commitment to innovation and technology, Clear Channel Outdoor’s success can also be attributed to their expansive network. This expansive network gives them access to a wide range of potential customers, which is an important factor in their success. The company’s commitment to innovation and technology, as well as their expansive network, have allowed them to capitalize on the growth of the out-of-home advertising industry. This surge in stock price is a sign that investors are confident in their future performance.

Price History

So far, the media coverage has been largely positive for the outdoor advertising company. The stock opened at $1.4 and closed at $1.3, a drop of 5.7% from the previous closing price of 1.4. It is clear that investors are optimistic about Clear Channel Outdoor Holdings, Inc., as the company’s stock continues to surge towards new heights. Despite the slight dip in the stock price, analysts remain bullish on the company’s future prospects. Analysts have noted that the company is well-positioned to benefit from the growth of digital outdoor advertising, which is expected to increase in the coming years. The company has reported strong sales and earnings growth in the past year, which has helped to boost investor confidence in the stock.

Additionally, the company has been expanding its presence in the outdoor advertising space, which has been a major driver of the stock’s recent gains. The stock has seen consistent growth despite the volatile market conditions and is expected to continue to climb in the coming weeks and months. It is clear that investors are confident in the company’s future prospects and are optimistic about its long-term prospects. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CCO. More…

| Total Revenues | Net Income | Net Margin |

| 2.51k | -131.34 | -4.6% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CCO. More…

| Operations | Investing | Financing |

| 134.77 | -228.76 | -162.68 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CCO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.99k | 8.36k | -7.11 |

Key Ratios Snapshot

Some of the financial key ratios for CCO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.2% | 4.5% | 8.7% |

| FCF Margin | ROE | ROA |

| -2.2% | -4.1% | 2.7% |

VI Analysis

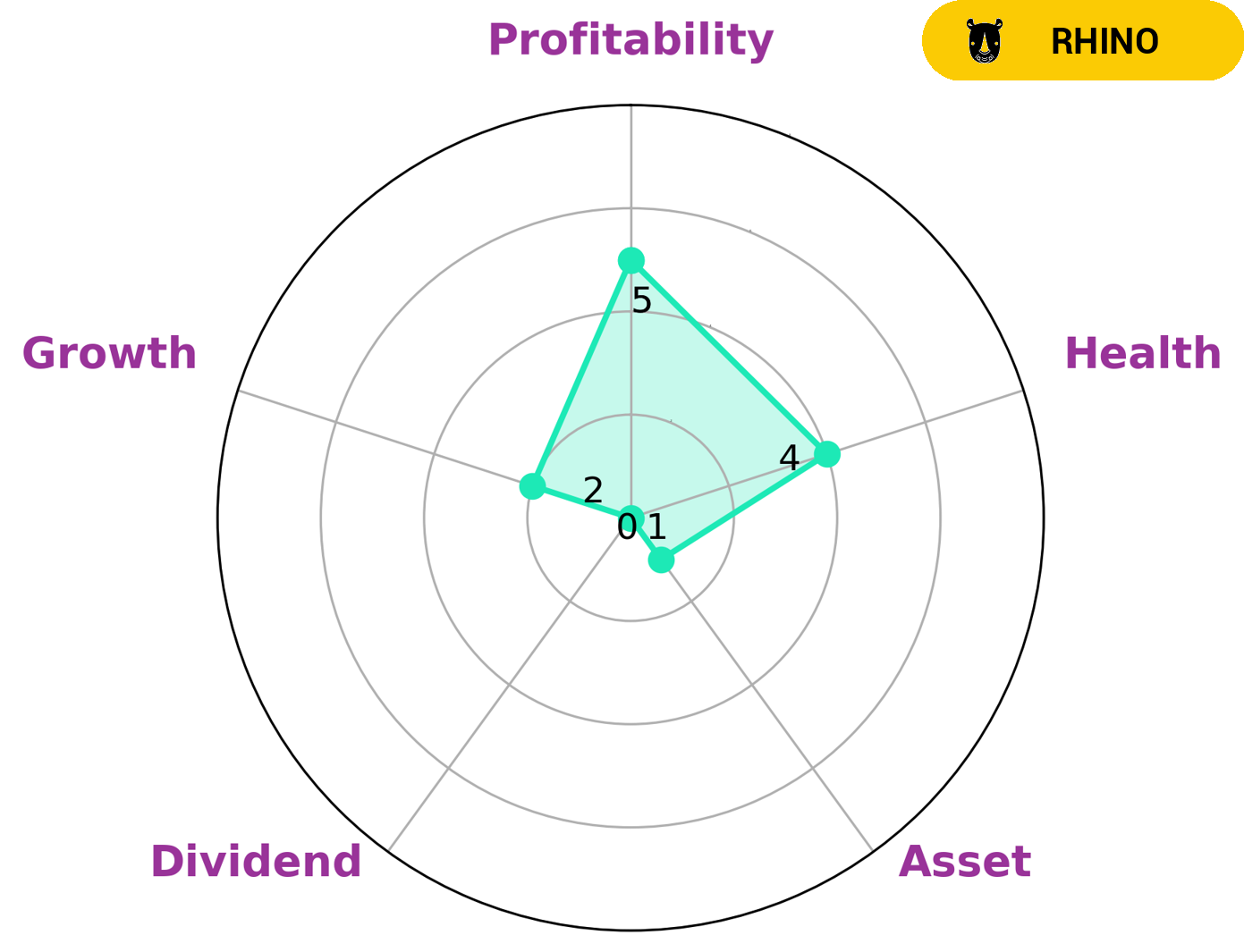

CLEAR CHANNEL OUTDOOR’s fundamentals reflect its long term potential, and can be easily analyzed using the VI app. The app’s Star Chart gives the company an intermediate health score of 4/10 with regard to its cashflows and debt, suggesting it might be able to pay off debt and fund future operations. Moreover, it is strong in profitability, medium in dividend strength and weak in asset and growth. The company is classified as a ‘rhino’ by the VI app; a type of company that has achieved moderate revenue or earnings growth. Investors who are interested in such companies should pay attention to the company’s financials to assess future potential. It is also important to look at the competitive landscape to ensure that CLEAR CHANNEL OUTDOOR has the competitive edge over its rivals. Investors should also take note of the company’s management team and their track record. In addition, they should consider the company’s long-term strategy and evaluate how it can create value for shareholders in the future. Finally, investors should understand the risks associated with investing in CLEAR CHANNEL OUTDOOR and make sure that the potential rewards outweigh these risks. More…

VI Peers

Clear Channel Outdoor Holdings Inc is one of the world’s largest outdoor advertising companies. Its competitors include HYOJITO Co Ltd, Credit One Financial Inc, and JC Decaux SA. Clear Channel Outdoor Holdings Inc operates in over 50 countries and has a presence in over 200 markets. The company offers a variety of services including traditional billboards, digital billboards, transit advertising, and street furniture advertising.

– HYOJITO Co Ltd ($TSE:7368)

HYOJITO Co Ltd is a Japanese company that manufactures and sells construction materials. The company has a market cap of 6.98B as of 2022 and a ROE of 5.41%. HYOJITO Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange.

– Credit One Financial Inc ($LTS:0MGO)

JCDecaux SA is a French out-of-home advertising company founded in 1964 by Jean-Claude Decaux. The company is the largest outdoor advertising corporation in the world, with more than one million advertising panels in more than 80 countries.

JCDecaux’s market cap as of 2022 is 3.25B. The company has a ROE of 7.68%.

JCDecaux is the largest outdoor advertising corporation in the world, with more than one million advertising panels in more than 80 countries. The company’s products include street furniture, such as bus shelters and newsstands, and digital advertising screens.

Summary

Clear Channel Outdoor Holdings, Inc. has seen a significant increase in its stock price, reaching $1.33 per share. Despite this positive news, the stock price moved down the same day. Investing in Clear Channel Outdoor Holdings, Inc. may be a risky proposition due to the volatile nature of the stock, but the company’s recent performance suggests potential for growth. Investors should do their own research and consult a financial advisor before committing to an investment in Clear Channel Outdoor Holdings, Inc. to ensure they understand the risks and rewards associated with investing.

Recent Posts