Clear Channel Outdoor Extends Credit Facilities Maturity

June 14, 2023

☀️Trending News

Clear Channel Outdoor ($NYSE:CCO), one of the world’s largest outdoor advertising companies, has recently amended and extended the maturity of its credit facilities. This extension is designed to provide the company with additional financial flexibility and liquidity for its future operations. It offers a range of outdoor ad formats such as billboards, digital signs, airport displays, bus shelters, street furniture, and more. CLEAR CHANNEL OUTDOOR also has a variety of innovative technologies that enable data-driven campaigns that boost results and optimize ROI.

By extending its credit facilities maturity, CLEAR CHANNEL OUTDOOR will be able to better manage its financial resources. It will also have access to additional capital which can be used to expand its operations and grow its customer base. This move is a strategic one that should benefit the company in the long-term as it works to remain a leader in the outdoor advertising industry.

Market Price

On Monday, Clear Channel Outdoor extended the maturity of its existing revolving credit facilities. This extension will help the company to continue to navigate through a volatile business environment. The stock opened at $1.3 and closed at $1.3, down by 1.5% from the previous closing price of $1.3.

Its portfolio of advertising solutions includes traditional billboards, digital displays, transit advertising, and airport displays. With the maturity date of its existing credit facilities being extended, Clear Channel Outdoor will have more financial flexibility to focus on its core business operations and better protect its balance sheet. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CCO. More…

| Total Revenues | Net Income | Net Margin |

| 2.5k | -41.65 | 0.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CCO. More…

| Operations | Investing | Financing |

| 101.44 | -153.78 | -35.68 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CCO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.95k | 8.28k | -6.95 |

Key Ratios Snapshot

Some of the financial key ratios for CCO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.9% | 17.9% | 11.2% |

| FCF Margin | ROE | ROA |

| -3.4% | -5.3% | 3.6% |

Analysis

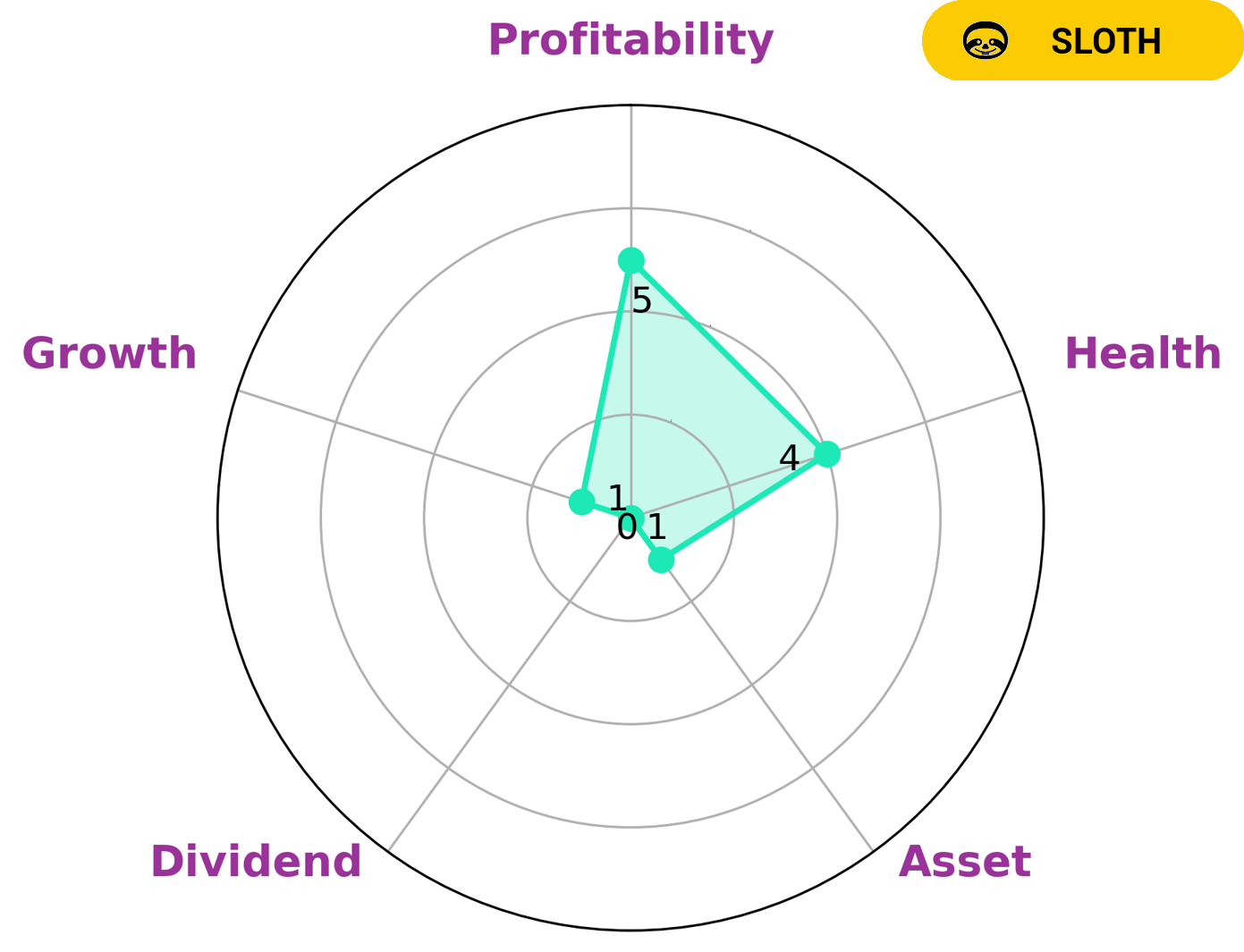

GoodWhale has conducted an analysis of CLEAR CHANNEL OUTDOOR’s fundamentals. According to our Star Chart, the company is strong in liquidity, medium in profitability, and weak in asset, dividend, and growth. Its intermediate health score of 4/10 means that while its cash flows and debt are not ideal, it is likely to be able to pay off its debt and fund future operations. We classify CLEAR CHANNEL OUTDOOR as a ‘sloth’ type of company, meaning it has achieved revenue or earnings growth slower than the overall economy. Investors interested in CLEAR CHANNEL OUTDOOR should be aware of its low asset and dividend strength, and take into account the fact that it might not be a good fit for those seeking high revenue or earnings growth. However, due to the company’s intermediate health score, it could be a good opportunity for those looking for stable operations with a reasonable return on their investment. More…

Peers

Clear Channel Outdoor Holdings Inc is one of the world’s largest outdoor advertising companies. Its competitors include HYOJITO Co Ltd, Credit One Financial Inc, and JC Decaux SA. Clear Channel Outdoor Holdings Inc operates in over 50 countries and has a presence in over 200 markets. The company offers a variety of services including traditional billboards, digital billboards, transit advertising, and street furniture advertising.

– HYOJITO Co Ltd ($TSE:7368)

HYOJITO Co Ltd is a Japanese company that manufactures and sells construction materials. The company has a market cap of 6.98B as of 2022 and a ROE of 5.41%. HYOJITO Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange.

– Credit One Financial Inc ($LTS:0MGO)

JCDecaux SA is a French out-of-home advertising company founded in 1964 by Jean-Claude Decaux. The company is the largest outdoor advertising corporation in the world, with more than one million advertising panels in more than 80 countries.

JCDecaux’s market cap as of 2022 is 3.25B. The company has a ROE of 7.68%.

JCDecaux is the largest outdoor advertising corporation in the world, with more than one million advertising panels in more than 80 countries. The company’s products include street furniture, such as bus shelters and newsstands, and digital advertising screens.

Summary

Clear Channel Outdoor has amended and extended the maturity of its credit facilities. This move is a positive sign for future investors, as it indicates that the company is confident in its outlook and is taking proactive steps to ensure long-term success. This development will likely enhance Clear Channel Outdoor’s ability to continue financing existing operations and pursue strategic opportunities. Ultimately, this will benefit investors by allowing the company to remain competitive in the industry and create long-term value for shareholders.

Recent Posts