CCO Intrinsic Value Calculator – Clear Channel Outdoor Sees Out-of-Home Market Surge to 2029

April 1, 2023

Trending News ☀️

Clear Channel Outdoor ($NYSE:CCO), a world-leading out-of-home advertising company, has seen tremendous growth in their OOH market. According to predictions, the OOH market is predicted to experience a massive surge in growth up to 2029, with JCDecaux (France) and Clear Channel leading the charge. With their expansive network of billboards, digital display boards, and other forms of outdoor advertising, Clear Channel Outdoor has become a major player in the OOH market. Clear Channel Outdoor has become renowned for its ability to provide creatives with a powerful platform to reach consumers in an effective and impactful way.

From large format billboards to digital signs, Clear Channel Outdoor has enabled the growth of its clients with innovative solutions that capture the attention of consumers. As the OOH market continues to evolve and develop, Clear Channel Outdoor will remain at the forefront of the industry. With their strategic outlook and impressive portfolio of OOH solutions, they are poised to take advantage of the potential of this surge in the OOH market.

Price History

CLEAR CHANNEL OUTDOOR (CCO) is experiencing a surge in the out-of-home advertising market, with its stock opening at $1.2 and closing at $1.2 on Friday, a 7.1% rise from prior closing price of 1.1. This is largely due to the increasing demand for digital inventory and the shift of more traditional ad dollars to digital. CCO is investing heavily in digital capabilities and expanding its network, enabling them to take advantage of these trends and capture a larger portion of the out-of-home ad market. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CCO. More…

| Total Revenues | Net Income | Net Margin |

| 2.48k | -96.6 | -2.0% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CCO. More…

| Operations | Investing | Financing |

| 139.99 | -221.7 | -32.72 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CCO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 5.09k | 8.35k | -6.88 |

Key Ratios Snapshot

Some of the financial key ratios for CCO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -2.6% | 1.6% | 7.9% |

| FCF Margin | ROE | ROA |

| -1.8% | -3.7% | 2.4% |

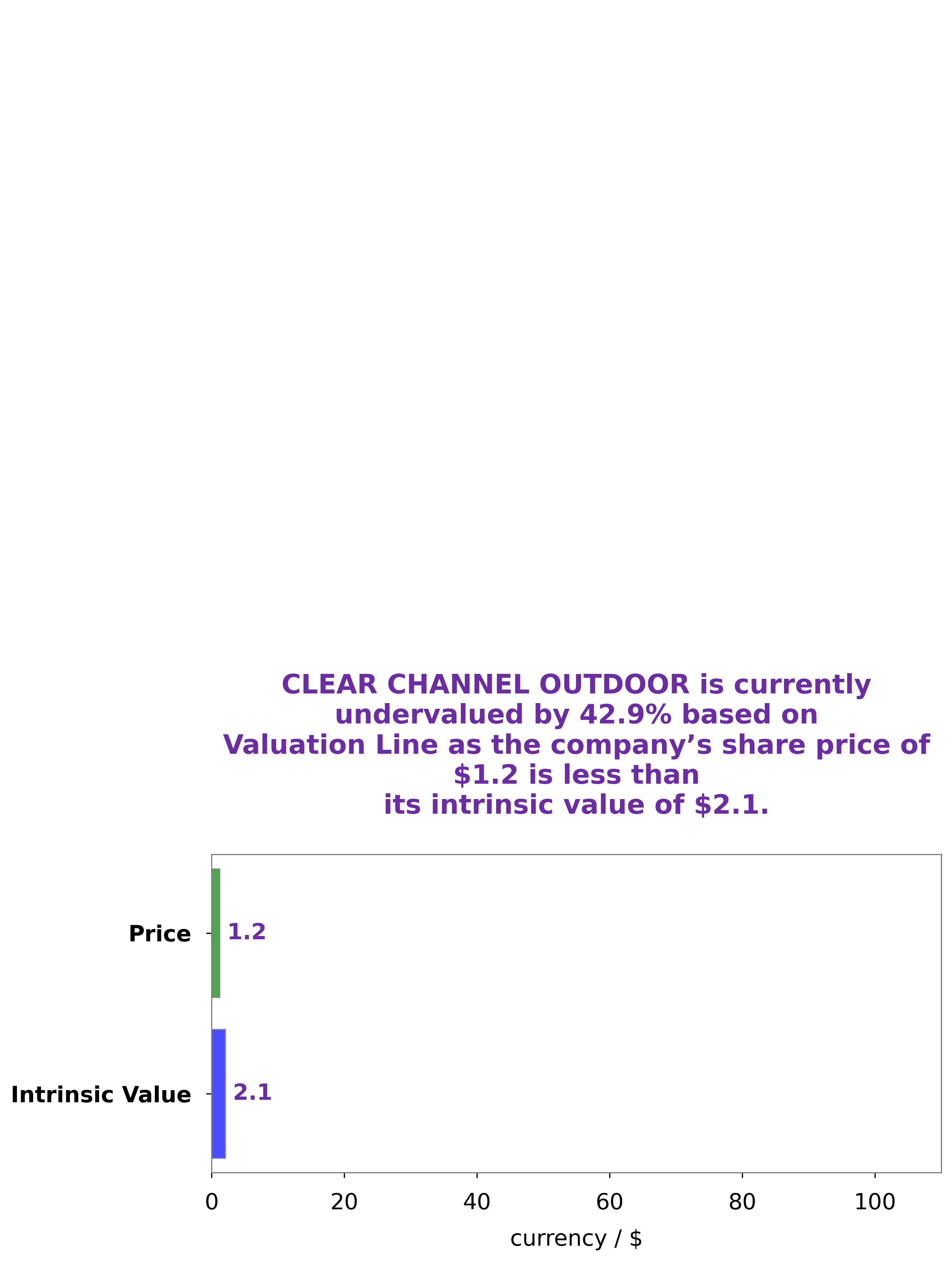

Analysis – CCO Intrinsic Value Calculator

At GoodWhale, we conduct a detailed analysis of CLEAR CHANNEL OUTDOOR’s fundamentals. Our proprietary Valuation Line reveals that the fair value of CLEAR CHANNEL OUTDOOR share should be around $2.1. However, the current price is trading at only $1.2, making it significantly undervalued by 44.1%. This presents investors a great opportunity to buy and hold the stock, with potential to gain returns in the future. More…

Peers

Clear Channel Outdoor Holdings Inc is one of the world’s largest outdoor advertising companies. Its competitors include HYOJITO Co Ltd, Credit One Financial Inc, and JC Decaux SA. Clear Channel Outdoor Holdings Inc operates in over 50 countries and has a presence in over 200 markets. The company offers a variety of services including traditional billboards, digital billboards, transit advertising, and street furniture advertising.

– HYOJITO Co Ltd ($TSE:7368)

HYOJITO Co Ltd is a Japanese company that manufactures and sells construction materials. The company has a market cap of 6.98B as of 2022 and a ROE of 5.41%. HYOJITO Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange.

– Credit One Financial Inc ($LTS:0MGO)

JCDecaux SA is a French out-of-home advertising company founded in 1964 by Jean-Claude Decaux. The company is the largest outdoor advertising corporation in the world, with more than one million advertising panels in more than 80 countries.

JCDecaux’s market cap as of 2022 is 3.25B. The company has a ROE of 7.68%.

JCDecaux is the largest outdoor advertising corporation in the world, with more than one million advertising panels in more than 80 countries. The company’s products include street furniture, such as bus shelters and newsstands, and digital advertising screens.

Summary

Clear Channel Outdoor (CCO) is one of the leading global out-of-home (OOH) advertising companies. Analysts believe CCO’s stock price will continue to increase due to its digital expansion, capacity for innovation, and data-driven approach to OOH advertising. Recent investments in the company have already seen CCO’s stock rise, with the company showing encouraging signs of growth. Investors looking to tap into the OOH market should look no further than CCO as a sound investment opportunity.

Recent Posts