Activist Push Results in Clear Channel Outdoor Gains

May 17, 2023

Trending News ☀️

Clear Channel Outdoor ($NYSE:CCO) (CCO) has seen a significant increase in its stock price in recent months, as a result of a powerful activist push for the sale of the entire business. The company’s portfolio of products includes traditional billboards, digital displays, transit displays, and airport displays. These investors have argued that the company’s current market value is significantly undervalued when compared to its peers in the outdoor advertising industry. They have also argued that the company could generate substantial value by divesting its assets or restructuring its operations. As a result of the pressure from these activists, Clear Channel Outdoor’s shares have seen an impressive rally over the past several months.

In addition, the company has recently announced plans to explore strategic alternatives such as a sale or spin-off of its assets. The activist push has clearly paid off for Clear Channel Outdoor shareholders. While it is still uncertain exactly what the future holds for the company, it is clear that it has been able to capitalize on the momentum generated by the activists to create value for its shareholders.

Market Price

Activists have been pushing for changes at CLEAR CHANNEL OUTDOOR and their efforts have resulted in visible gains. On Tuesday, the company’s stock opened at $1.1 and closed at the same, signaling a 3.6% decrease from the previous closing price of $1.1. This decrease, however, is still a notable improvement in comparison to the company’s performance in recent months. Although the number of shares traded on Tuesday was lower than average, it is still seen as an encouraging sign for the future. Live Quote…

About the Company

Income Snapshot

Below shows the total revenue, net income and net margin for CCO. More…

| Total Revenues | Net Income | Net Margin |

| 2.5k | -41.65 | 0.2% |

Cash Flow Snapshot

Below shows the cash from operations, investing and financing for CCO. More…

| Operations | Investing | Financing |

| 101.44 | -153.78 | -35.68 |

Balance Sheet Snapshot

Below shows the total assets, liabilities and book value per share for CCO. More…

| Total Assets | Total Liabilities | Book Value Per Share |

| 4.95k | 8.28k | -6.95 |

Key Ratios Snapshot

Some of the financial key ratios for CCO are shown below. More…

| 3Y Rev Growth | 3Y Operating Profit Growth | Operating Margin |

| -1.9% | 17.9% | 11.2% |

| FCF Margin | ROE | ROA |

| -3.4% | -5.3% | 3.6% |

Analysis

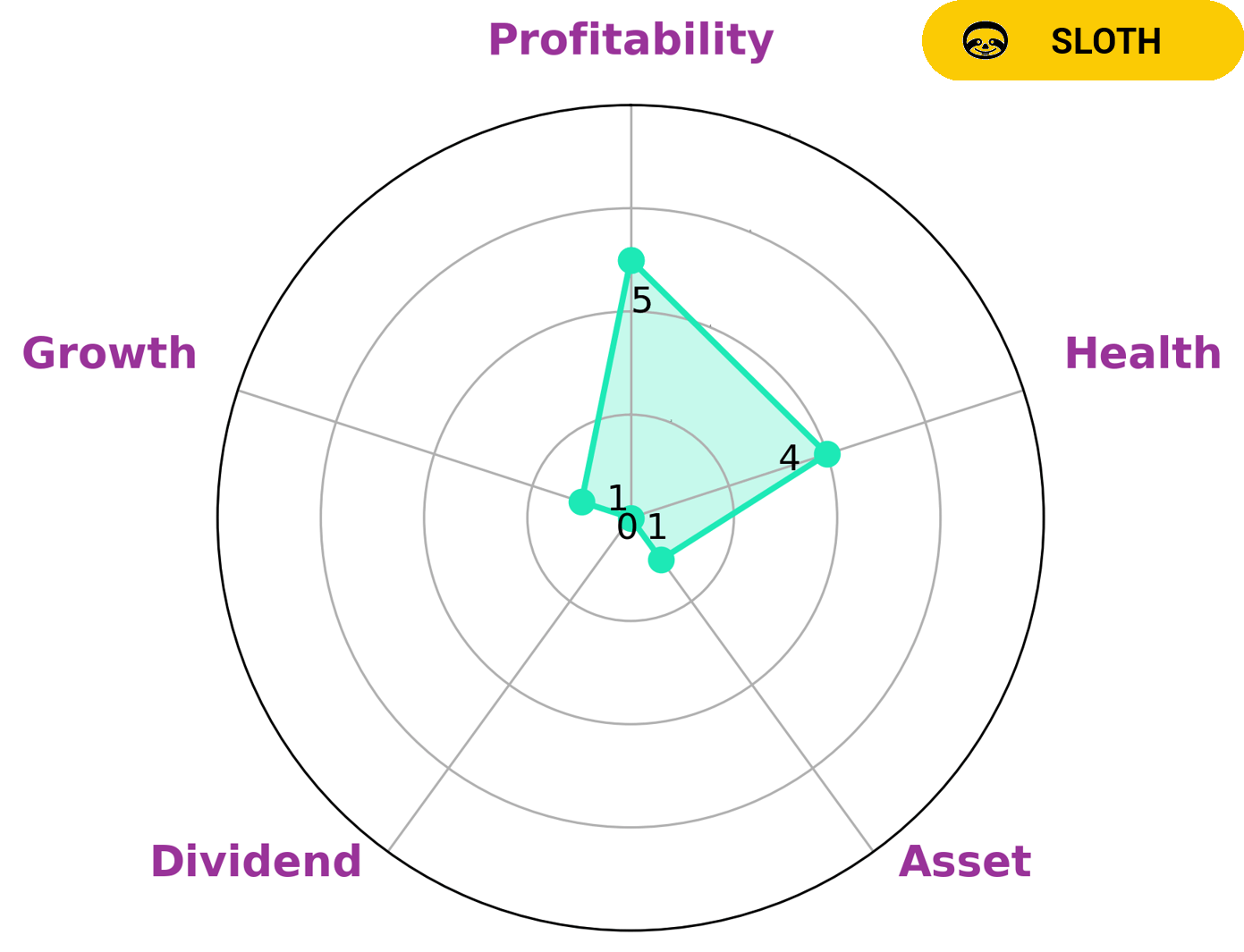

At GoodWhale, we have conducted an analysis of CLEAR CHANNEL OUTDOOR’s fundamentals. Based on our Star Chart, we have determined that this company is classified as a ‘sloth’, meaning that it has achieved revenue or earnings growth slower than the overall economy. As a result, this company may be attractive to different types of investors. For example, value investors may be attracted to CLEAR CHANNEL OUTDOOR due to its willingness to pay off debt and fund future operations, as it has an intermediate health score of 4/10. Overall, our analysis has determined that CLEAR CHANNEL OUTDOOR is strong in liquidity, medium in profitability and weak in asset, dividend, and growth. This may make it attractive to certain types of investors, such as those who look for lower risks and higher stability in their investments. More…

Peers

Clear Channel Outdoor Holdings Inc is one of the world’s largest outdoor advertising companies. Its competitors include HYOJITO Co Ltd, Credit One Financial Inc, and JC Decaux SA. Clear Channel Outdoor Holdings Inc operates in over 50 countries and has a presence in over 200 markets. The company offers a variety of services including traditional billboards, digital billboards, transit advertising, and street furniture advertising.

– HYOJITO Co Ltd ($TSE:7368)

HYOJITO Co Ltd is a Japanese company that manufactures and sells construction materials. The company has a market cap of 6.98B as of 2022 and a ROE of 5.41%. HYOJITO Co Ltd is a publicly traded company listed on the Tokyo Stock Exchange.

– Credit One Financial Inc ($LTS:0MGO)

JCDecaux SA is a French out-of-home advertising company founded in 1964 by Jean-Claude Decaux. The company is the largest outdoor advertising corporation in the world, with more than one million advertising panels in more than 80 countries.

JCDecaux’s market cap as of 2022 is 3.25B. The company has a ROE of 7.68%.

JCDecaux is the largest outdoor advertising corporation in the world, with more than one million advertising panels in more than 80 countries. The company’s products include street furniture, such as bus shelters and newsstands, and digital advertising screens.

Summary

Investors in Clear Channel Outdoor (CCO) have been closely watching the stock since news of an activist push for the sale of the entire company broke earlier this week. Despite the initial market enthusiasm, the stock price declined slightly on the same day, indicating that investors were wary of the potential outcome. Moving forward, it remains to be seen whether the activist push will result in an increase in CCO’s stock value, or if its current trading levels will remain near its current price level. Investors should remain mindful of any developments in the case, as the outcome could potentially have a large impact on the company’s future performance.

Recent Posts